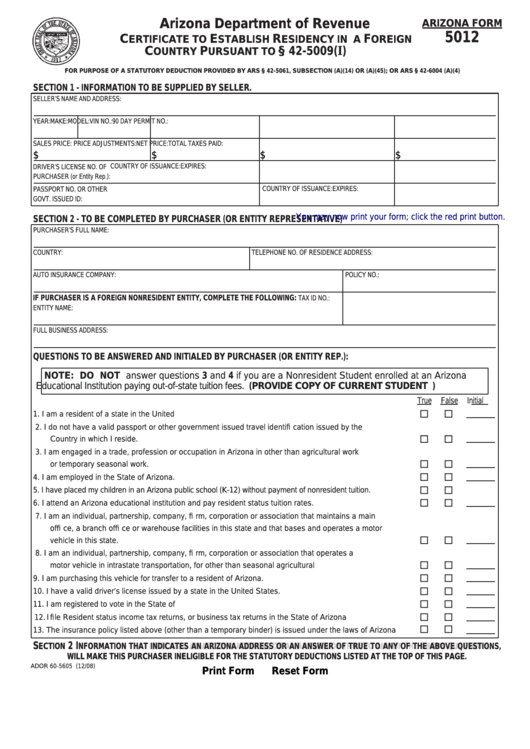

Arizona Department of Revenue

ARIZONA FORM

5012

C

E

R

F

ERTIFICATE TO

STABLISH

ESIDENCY IN A

OREIGN

C

P

A.R.S. § 42-5009(I)

OUNTRY

URSUANT TO

FOR PURPOSE OF A STATUTORY DEDUCTION PROVIDED BY ARS § 42-5061, SUBSECTION (A)(14) OR (A)(45); OR ARS § 42-6004 (A)(4)

SECTION 1 - INFORMATION TO BE SUPPLIED BY SELLER.

Section 1 only is fillable.

SELLER’S NAME AND ADDRESS:

YEAR:

MAKE:

MODEL:

VIN NO.:

90 DAY PERMIT NO.:

SALES PRICE:

PRICE ADJUSTMENTS:

NET PRICE:

TOTAL TAXES PAID:

$

$

$

$

COUNTRY OF ISSUANCE:

EXPIRES:

DRIVER’S LICENSE NO. OF

PURCHASER (or Entity Rep.):

COUNTRY OF ISSUANCE:

EXPIRES:

PASSPORT NO. OR OTHER

GOVT. ISSUED ID:

SECTION 2 - TO BE COMPLETED BY PURCHASER (OR ENTITY REPRESENTATIVE)

You may now print your form; click the red print button.

PURCHASER’S FULL NAME:

COUNTRY:

TELEPHONE NO. OF RESIDENCE ADDRESS:

AUTO INSURANCE COMPANY:

POLICY NO.:

IF PURCHASER IS A FOREIGN NONRESIDENT ENTITY, COMPLETE THE FOLLOWING:

TAX ID NO.:

ENTITY NAME:

FULL BUSINESS ADDRESS:

QUESTIONS TO BE ANSWERED AND INITIALED BY PURCHASER (OR ENTITY REP.):

NOTE: DO NOT answer questions 3 and 4 if you are a Nonresident Student enrolled at an Arizona

Educational Institution paying out-of-state tuition fees. (PROVIDE COPY OF CURRENT STUDENT I.D. CARD)

True False

Initial

1. I am a resident of a state in the United States.................................................................................................

2. I do not have a valid passport or other government issued travel identifi cation issued by the

Country in which I reside. ................................................................................................................................

3. I am engaged in a trade, profession or occupation in Arizona in other than agricultural work

or temporary seasonal work. ...........................................................................................................................

4. I am employed in the State of Arizona. ............................................................................................................

5. I have placed my children in an Arizona public school (K-12) without payment of nonresident tuition. ...................

6. I attend an Arizona educational institution and pay resident status tuition rates. ............................................

7. I am an individual, partnership, company, fi rm, corporation or association that maintains a main

offi ce, a branch offi ce or warehouse facilities in this state and that bases and operates a motor

vehicle in this state. .........................................................................................................................................

8. I am an individual, partnership, company, fi rm, corporation or association that operates a

motor vehicle in intrastate transportation, for other than seasonal agricultural work.......................................

9. I am purchasing this vehicle for transfer to a resident of Arizona. ...................................................................

10. I have a valid driver’s license issued by a state in the United States. .............................................................

11. I am registered to vote in the State of Arizona.................................................................................................

12. I fi le Resident status income tax returns, or business tax returns in the State of Arizona ...............................

13. The insurance policy listed above (other than a temporary binder) is issued under the laws of Arizona ........

S S

2 I 2 I

ECTION

ECTION

NFORMATION THAT INDICATES AN ARIZONA ADDRESS OR AN ANSWER OF TRUE TO ANY OF THE ABOVE QUESTIONS,

NFORMATION THAT INDICATES AN ARIZONA ADDRESS OR AN ANSWER OF TRUE TO ANY OF THE ABOVE QUESTIONS,

WILL MAKE THIS PURCHASER INELIGIBLE FOR THE STATUTORY DEDUCTIONS LISTED AT THE TOP OF THIS PAGE.

WILL MAKE THIS PURCHASER INELIGIBLE FOR THE STATUTORY DEDUCTIONS LISTED AT THE TOP OF THIS PAGE.

ADOR 60-5605 (12/08)

Print Form

Reset Form

1

1 2

2