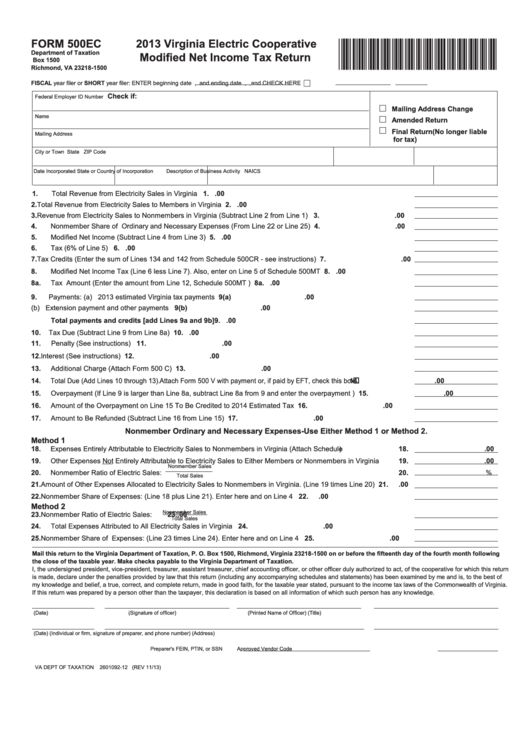

FORM 500EC

2013 Virginia Electric Cooperative

*VAECOP113888*

Department of Taxation

Modified Net Income Tax Return

P.O. Box 1500

Richmond, VA 23218-1500

FISCAL year filer or SHORT year filer: ENTER beginning date

,

and ending date

,

, and CHECK HERE j

Check if:

Federal Employer ID Number

Mailing Address Change

Name

Amended Return

Final Return (No longer liable

Mailing Address

for tax)

City or Town

State

ZIP Code

Date Incorporated

State or Country of Incorporation

Description of Business Activity

NAICS

1.

Total Revenue from Electricity Sales in Virginia ...........................................................................................................1.

.00

2.

Total Revenue from Electricity Sales to Members in Virginia ........................................................................................2.

.00

3.

Revenue from Electricity Sales to Nonmembers in Virginia (Subtract Line 2 from Line 1) ..........................................3.

.00

4.

Nonmember Share of Ordinary and Necessary Expenses (From Line 22 or Line 25) .................................................4.

.00

5.

Modified Net Income (Subtract Line 4 from Line 3) .......................................................................................................5.

.00

6.

Tax (6% of Line 5) ........................................................................................................................................................6.

.00

7.

.00

Tax Credits (Enter the sum of Lines 134 and 142 from Schedule 500CR - see instructions) .......................................7.

8.

Modified Net Income Tax (Line 6 less Line 7). Also, enter on Line 5 of Schedule 500MT ............................................8.

.00

8a.

Tax Amount (Enter the amount from Line 12, Schedule 500MT ) ..............................................................................8a.

.00

9. Payments:

(a) 2013 estimated Virginia tax payments ..........................................................................................9(a)

.00

(b) Extension payment and other payments .....................................................................................9(b)

.00

Total payments and credits [add Lines 9a and 9b] .................................................................................................9.

.00

10. Tax Due (Subtract Line 9 from Line 8a) ........................................................................................................................10.

.00

11.

.00

Penalty (See instructions) ..........................................................................................................................................11.

12.

Interest (See instructions) ...........................................................................................................................................12.

.00

13.

Additional Charge (Attach Form 500 C) .......................................................................................................................13.

.00

14.

Total Due (Add Lines 10 through 13). Attach Form 500 V with payment or, if paid by EFT, check this box

....................14.

.00

15.

Overpayment (If Line 9 is larger than Line 8a, subtract Line 8a from 9 and enter the overpayment ) ........................15.

.00

16.

Amount of the Overpayment on Line 15 To Be Credited to 2014 Estimated Tax ........................................................ 16.

.00

17.

Amount to Be Refunded (Subtract Line 16 from Line 15) ...........................................................................................17.

.00

Nonmember Ordinary and Necessary Expenses-Use Either Method 1 or Method 2.

Method 1

18.

Expenses Entirely Attributable to Electricity Sales to Nonmembers in Virginia (Attach Schedule) .................................. 18.

.00

19.

Other Expenses Not Entirely Attributable to Electricity Sales to Either Members or Nonmembers in Virginia ............ 19.

.00

Nonmember Sales

20.

Nonmember Ratio of Electric Sales:

....................................................................................................... 20.

%

Total Sales

21.

Amount of Other Expenses Allocated to Electricity Sales to Nonmembers in Virginia. (Line 19 times Line 20) .........21.

.00

22.

Nonmember Share of Expenses: (Line 18 plus Line 21). Enter here and on Line 4 ..................................................22.

.00

Method 2

Nonmember Sales

23.

Nonmember Ratio of Electric Sales:

................................................................................................. 23.

.00

Total Sales

24.

Total Expenses Attributed to All Electricity Sales in Virginia .......................................................................................24.

.00

25.

.00

Nonmember Share of Expenses: (Line 23 times Line 24). Enter here and on Line 4 ...............................................25.

Mail this return to the Virginia Department of Taxation, P. O. Box 1500, Richmond, Virginia 23218-1500 on or before the fifteenth day of the fourth month following

the close of the taxable year. Make checks payable to the Virginia Department of Taxation.

I, the undersigned president, vice-president, treasurer, assistant treasurer, chief accounting officer, or other officer duly authorized to act, of the cooperative for which this return

is made, declare under the penalties provided by law that this return (including any accompanying schedules and statements) has been examined by me and is, to the best of

my knowledge and belief, a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the income tax laws of the Commonwealth of Virginia.

If this return was prepared by a person other than the taxpayer, this declaration is based on all information of which such person has any knowledge.

(Date)

(Signature of officer)

(Printed Name of Officer)

(Title)

(Date)

(Individual or firm, signature of preparer, and phone number)

(Address)

Preparer's FEIN, PTIN, or SSN

Approved Vendor Code

VA DEPT OF TAXATION

2601092-12 (REV 11/13)

1

1