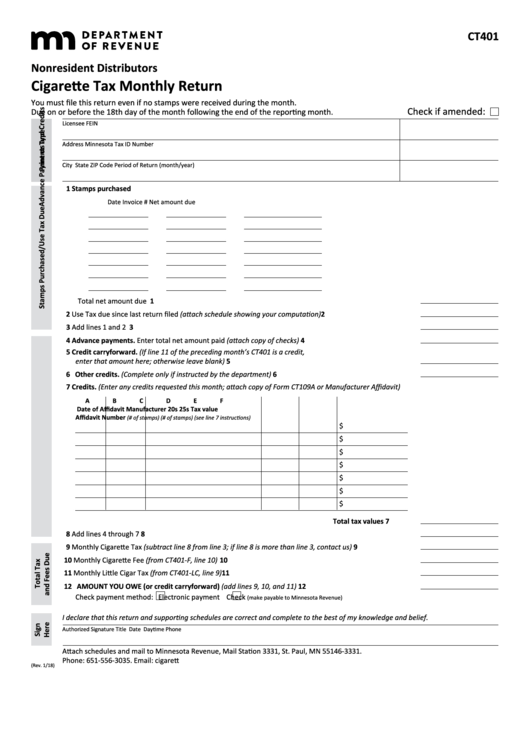

CT401

Nonresident Distributors

Cigarette Tax Monthly Return

You must file this return even if no stamps were received during the month.

Check if amended:

Due on or before the 18th day of the month following the end of the reporting month.

Licensee

FEIN

Address

Minnesota Tax ID Number

City

State

ZIP Code

Period of Return (month/year)

1 Stamps purchased

Date

Invoice #

Net amount due

Total net amount due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Use Tax due since last return filed (attach schedule showing your computation) . . . . . . . . . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Advance payments. Enter total net amount paid (attach copy of checks) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Credit carryforward. (If line 11 of the preceding month’s CT401 is a credit,

enter that amount here; otherwise leave blank) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Other credits. (Complete only if instructed by the department) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Credits. (Enter any credits requested this month; attach copy of Form CT109A or Manufacturer Affidavit)

A

B

C

D

E

F

Date of

Affidavit

Manufacturer

20s

25s

Tax value

Affidavit

Number

(# of stamps) (# of stamps)

(see line 7 instructions)

$

$

$

$

$

$

$

Total tax values . . . . . . 7

8 Add lines 4 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Monthly Cigarette Tax (subtract line 8 from line 3; if line 8 is more than line 3, contact us) . . . . . . . . . . . . . . 9

10 Monthly Cigarette Fee (from CT401-F, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Monthly Little Cigar Tax (from CT401-LC, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 AMOUNT YOU OWE (or credit carryforward) (add lines 9, 10, and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Check payment method:

Electronic payment

Check

(make payable to Minnesota Revenue)

I declare that this return and supporting schedules are correct and complete to the best of my knowledge and belief.

Authorized Signature

Title

Date

Daytime Phone

Attach schedules and mail to Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331.

Phone: 651-556-3035. Email: cigarette.tobacco@state.mn.us

(Rev. 1/18)

1

1 2

2