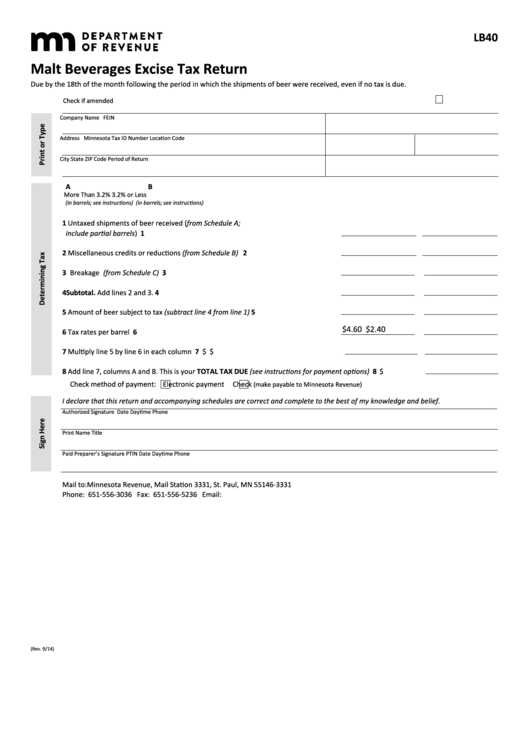

LB40

Malt Beverages Excise Tax Return

Due by the 18th of the month following the period in which the shipments of beer were received, even if no tax is due.

Check if amended

Company Name

FEIN

Address

Minnesota Tax ID Number

Location Code

City

State

ZIP Code

Period of Return

A

B

More Than 3 .2%

3 .2% or Less

(in barrels; see instructions)

(in barrels; see instructions)

1 Untaxed shipments of beer received (from Schedule A;

include partial barrels) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Miscellaneous credits or reductions (from Schedule B) . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Breakage (from Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Subtotal. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Amount of beer subject to tax (subtract line 4 from line 1) . . . . . . . . . . . . . . . . . . . . . 5

$4.60

$2.40

6 Tax rates per barrel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Multiply line 5 by line 6 in each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 $

$

8 Add line 7, columns A and B. This is your TOTAL TAX DUE (see instructions for payment options) . . . . . . . . . . . 8 $

Check method of payment:

Electronic payment

Check

(make payable to Minnesota Revenue)

I declare that this return and accompanying schedules are correct and complete to the best of my knowledge and belief.

Authorized Signature

Date

Daytime Phone

Print Name

Title

Paid Preparer’s Signature

PTIN

Date

Daytime Phone

Mail to: Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331

Phone: 651-556-3036 Fax: 651-556-5236 Email: alc.taxes@state.mn.us

(Rev. 9/14)

1

1 2

2 3

3