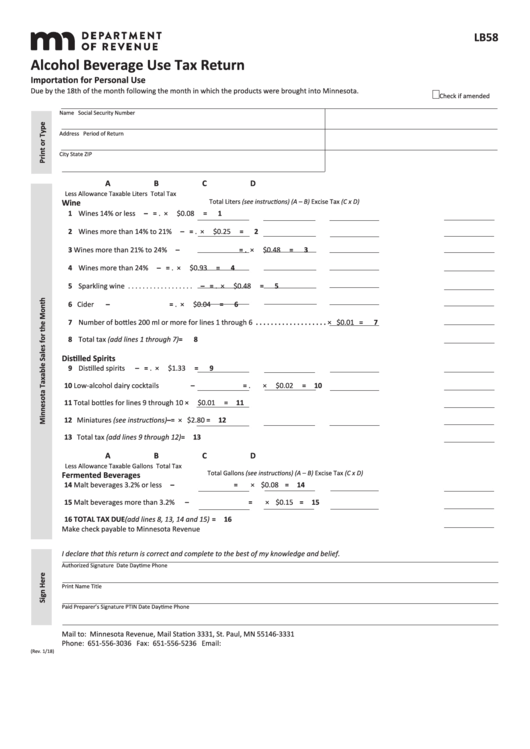

LB58

Alcohol Beverage Use Tax Return

Importation for Personal Use

Due by the 18th of the month following the month in which the products were brought into Minnesota.

Check if amended

Name

Social Security Number

Address

Period of Return

City

State

ZIP

A

B

C

D

Less Allowance

Taxable Liters

Total Tax

(see instructions)

(A – B)

(C x D)

Wine

Total Liters

Excise Tax

1 Wines 14% or less . . . . . . . . . . . . . . .

–

= .

×

$0.08

=

1

2 Wines more than 14% to 21% . . . . .

–

= .

×

$0.25

=

2

3 Wines more than 21% to 24% . . . . .

–

= .

×

$0.48

=

3

4 Wines more than 24% . . . . . . . . . . . .

–

= .

×

$0.93

=

4

5 Sparkling wine . . . . . . . . . . . . . . . . . .

–

= .

×

$0.48

=

5

6 Cider . . . . . . . . . . . . . . . . . . . . . . . . . .

–

= .

×

$0.04

=

6

7 Number of bottles 200 ml or more for lines 1 through 6 . . . . . . . . . . . . . . . . . . .

$0.01 =

7

×

8 Total tax (add lines 1 through 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .=

8

Distilled Spirits

9 Distilled spirits . . . . . . . . . . . . . . . . . .

–

= .

×

$1.33

=

9

10 Low-alcohol dairy cocktails . . . . . . . .

–

= .

×

$0.02

= 10

11 Total bottles for lines 9 through 10

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ×

$0.01

= 11

12 Miniatures (see instructions)

–

=

×

$2.80

= 12

13 Total tax (add lines 9 through 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .= 13

A

B

C

D

Less Allowance

Taxable Gallons

Total Tax

Total Gallons

(see instructions)

(A – B)

Excise Tax

(C x D)

Fermented Beverages

14 Malt beverages 3.2% or less . . . . . . .

–

=

×

$0.08

= 14

15 Malt beverages more than 3.2% . . . .

–

=

×

$0.15

= 15

16 TOTAL TAX DUE (add lines 8, 13, 14 and 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .= 16

Make check payable to Minnesota Revenue

I declare that this return is correct and complete to the best of my knowledge and belief.

Authorized Signature

Date

Daytime Phone

Print Name

Title

Paid Preparer’s Signature

PTIN

Date

Daytime Phone

Mail to: Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331

Phone: 651-556-3036 Fax: 651-556-5236 Email: alc.taxes@state.mn.us

(Rev. 1/18)

1

1 2

2