E

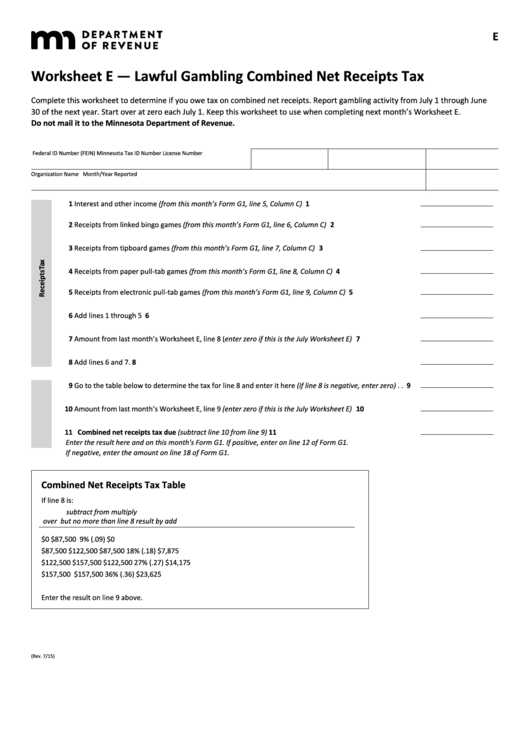

Worksheet E — Lawful Gambling Combined Net Receipts Tax

Complete this worksheet to determine if you owe tax on combined net receipts . Report gambling activity from July 1 through June

30 of the next year. Start over at zero each July 1. Keep this worksheet to use when completing next month’s Worksheet E.

Do not mail it to the Minnesota Department of Revenue.

Federal ID Number (FEIN)

Minnesota Tax ID Number

License Number

Organization Name

Month/Year Reported

1 Interest and other income (from this month’s Form G1, line 5, Column C) . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Receipts from linked bingo games (from this month’s Form G1, line 6, Column C) . . . . . . . . . . . . . . . . . . . . . 2

3 Receipts from tipboard games (from this month’s Form G1, line 7, Column C) . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Receipts from paper pull-tab games (from this month’s Form G1, line 8, Column C) . . . . . . . . . . . . . . . . . . . 4

5 Receipts from electronic pull-tab games (from this month’s Form G1, line 9, Column C) . . . . . . . . . . . . . . . . 5

6 Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Amount from last month’s Worksheet E, line 8 (enter zero if this is the July Worksheet E) . . . . . . . . . . . . . . 7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Go to the table below to determine the tax for line 8 and enter it here (if line 8 is negative, enter zero) . . 9

10 Amount from last month’s Worksheet E, line 9 (enter zero if this is the July Worksheet E) . . . . . . . . . . . . . 10

11 Combined net receipts tax due (subtract line 10 from line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Enter the result here and on this month's Form G1 . If positive, enter on line 12 of Form G1 .

If negative, enter the amount on line 18 of Form G1 .

Combined Net Receipts Tax Table

If line 8 is:

subtract from

multiply

over

but no more than

line 8

result by

add

$0

$87,500

9% ( .09)

$0

$87,500

$122,500

$87,500

18% ( .18)

$7,875

$122,500

$157,500

$122,500

27% ( .27)

$14,175

$157,500

$157,500

36% ( .36)

$23,625

Enter the result on line 9 above .

(Rev . 7/15)

1

1