Form Ifta 100-V - Payment Voucher And Instructions For Ifta Returns Filed Electronically

ADVERTISEMENT

Rev. 9/08

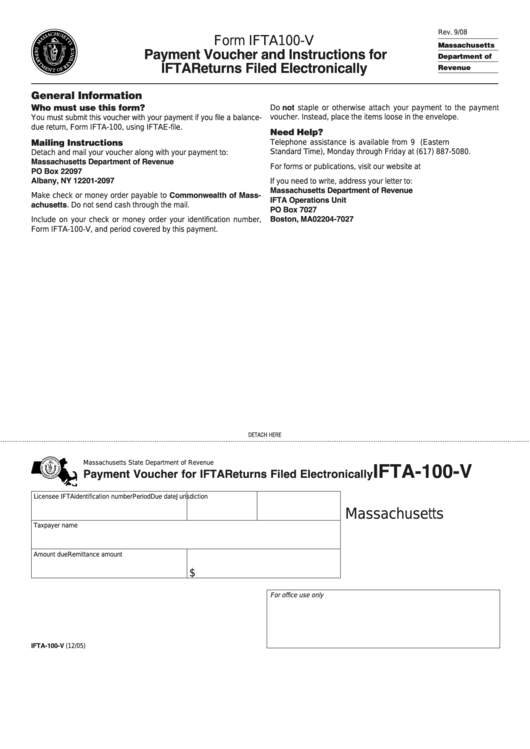

Form IFTA 100-V

Massachusetts

Payment Voucher and Instructions for

Department of

IFTA Returns Filed Electronically

Revenue

General Information

Who must use this form?

Do not staple or otherwise attach your payment to the payment

voucher. Instead, place the items loose in the envelope.

You must submit this voucher with your payment if you file a balance-

due return, Form IFTA-100, using IFTA E-file.

Need Help?

Mailing Instructions

Telephone assistance is available from 9 a.m. to 5 p.m. (Eastern

Standard Time), Monday through Friday at (617) 887-5080.

Detach and mail your voucher along with your payment to:

Massachusetts Department of Revenue

For forms or publications, visit our website at

PO Box 22097

Albany, NY 12201-2097

If you need to write, address your letter to:

Massachusetts Department of Revenue

Make check or money order payable to Commonwealth of Mass-

IFTA Operations Unit

achusetts. Do not send cash through the mail.

PO Box 7027

Boston, MA 02204-7027

Include on your check or money order your identification number,

Form IFTA-100-V, and period covered by this payment.

DETACH HERE

Massachusetts State Department of Revenue

IFTA-100-V

Payment Voucher for IFTA Returns Filed Electronically

Licensee IFTA identification number

Period

Due date

Jurisdiction

Massachusetts

Taxpayer name

Amount due

Remittance amount

$

For office use only

IFTA-100-V (12/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1