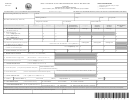

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 2991

Charleston, WV 25330-2991

Name

Address

Account #:

City

State

Zip

WV/TPT-709

WEST VIRGINIA TOBACCO PRODUCTS TAX REPORT

rtL191 v 15 - Web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory requirement by mail.

Please visit for additional information.

Period Ending:

Due Date:

FINAL

AMENDED

TOBACCO PRODUCTS REPORT SUMMARY

1.

Total Tax Due on Other Tobacco Products (Section 1 Line 21)

.

2.

Total Tax Due on Cigarettes (Sum of columns in Section 2 Line 49)

.

3.

Total Tax Due on Tobacco Products (Line 1 plus Line 2)

.

4.

Credit Carried Foward from Prior Period(s)

.

5.

Credit Due on OTP (Section 1 Line 22)

.

6.

Balance of Tax Due (Line 3 minus the sum of Line 4 and Line 5) Enter 0 if the sum of Line 4 and Line 5 is greater than Line 3

.

7.

Overpayment (Line 4 plus Line 5 minus Line 3) Enter 0 if Line 3 is greater than the sum of Line 4 and Line 5

.

8.

Credit Amount (For Credit, enter full overpayment amount from Line 7, else enter 0)

.

9.

Refund Amount (For Refund, enter full overpayment amount from Line 7, else enter 0).

.

SECTION 1 - OTHER TOBACCO PRODUCTS TAX CALCULATION

Gross Invoice Price of Sales/Use in West Virginia

10.

.

(You must have copies of invoices, available upon request, etc. to verify this figure)

11.

Total Gross Invoice Price of Returns for Credit

.

12.

Less Statutory Allowance (Line 11 multiplied by Rate)

0.0500

.

13.

Total Credit (Line 11 minus Line 12)

.

14.

Total Gross Invoice Price (Line 10 minus Line 13) Enter 0 if Line 13 is greater than Line 10

.

15.

Total Gross Invoice Price Credit (Line 13 minus Line 10) Enter 0 if Line 10 is greater than Line 13

.

16.

Tax Rate

0.0700

17.

Gross Tax Due (Line 14 multiplied by Line 16)

.

18.

Gross Credit Due (Line 15 multiplied by Line 16)

.

19.

Discount Rate

0.0400

20.

Dealer Discount (The greater of Line 17 or Line 18 multiplied by Line 19)

.

21.

Tax Due on Other Tobacco Products (If Line 17 is greater than 0, enter Line 17 minus Line 20)

.

22.

Credit Due on Other Tobacco Products (If Line 18 is greater than 0, enter Line 18 minus Line 20)

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P O Box 2991, Charleston, WV 25330-2991

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www wvtax gov

O

4

2

0

3

0

9

0

1

W

File online at https://mytaxes wvtax gov

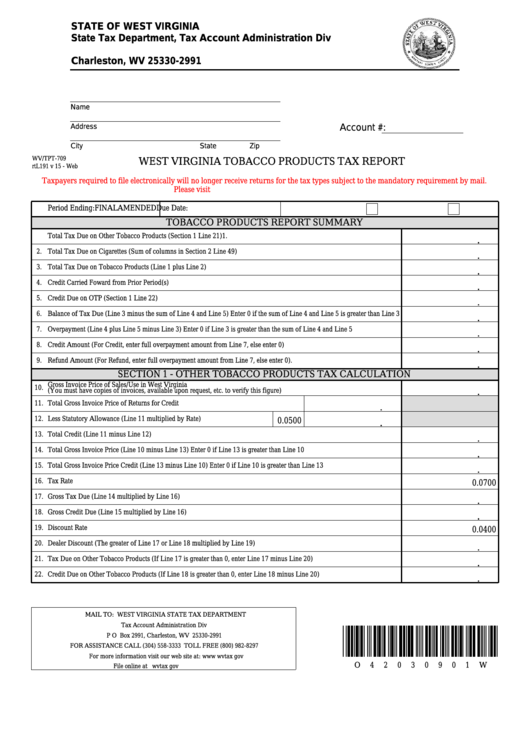

1

1 2

2