Insurance Premium Estimated Tax Instructions - Minnesota Department Of Revenue

ADVERTISEMENT

Insurance Premium Estimated Tax Instructions

For property, casualty and title insurance companies filing Form M11, for life insurance companies filing M11L and

for township mutual insurance companies filing Form M11T (M.S. 297I.05, subd. 1-4)

Filing Requirements

Worksheet Instructions

numbers. When paying electronically, you

must use an account not associated with any

You must make estimated tax payments if

Step 2

foreign banks.

you estimate your Minnesota insurance pre-

If you choose to pay the estimated tax in full,

mium tax (as reported on Form M11, M11L

If you use other electronic payment

enter the amount from step 1 on step 2, Col-

or M11T) to be more than $500 this year.

methods, such as ACH credit method or

umn A. Otherwise, divide step 1 by four, and

Fed Wire, instructions are available on our

enter the result in Columns A, B, C and D.

Required Annual Payment. To avoid

website or by calling Business Registration

penalties and interest, your required an-

Step 3

Office at 651-282-5225 or 1-800-657-3605.

nual payment of estimated tax must equal

If you elected to have all or a portion of your

100 percent of last year’s tax liability or 80

Check Payment

previous year’s refund applied as a credit

percent of the actual tax due for the current

If you’re not required to pay electronically

to your estimated tax, enter the amount in

year, whichever is less. If you did not have

and are paying by check, visit our website

Column A.

an insurance premium tax liability last year,

at and click on

you are not required to pay estimated tax

If step 3 is more than step 2 for any quarter,

“Make a Payment” and then “By check” to

for the current year.

include the difference as an overpayment

create a voucher. Print and mail the voucher

credit in step 3 of the next quarter’s column.

To determine your estimated tax payment

with your check payable to Minnesota

Any overpayment credit resulting from the

amounts, complete the worksheet below.

Revenue.

fourth installment will be refunded when

Due Dates. Payments are due quarterly on

When you pay by check, your check autho-

you file Form M11, M11L or M11T.

March 15, June 15, Sept. 15 and Dec. 15.

rizes us to make a one-time electronic fund

When the due date falls on a Saturday, Sun-

Payments

transfer from your account. You may not

day or legal holiday, payments electronically

receive your cancelled check. Do not send a

Electronic Payments

made or postmarked on the next business

payment voucher if you pay electronically or

If your total insurance taxes and surcharges

day are considered timely.

no amount is due.

due for the last 12-month period ending

No billings or reminders will be sent.

Note: Express deliveries only should be ad-

June 30 is $10,000 or more, you are required

dressed to Minnesota Revenue, Insurance

to pay your tax electronically in all subse-

Underpaying Installments. If you un-

Taxes Section, 600 North Robert Street,

quent years.

derpay any installment or did not pay by

St. Paul, MN 55101.

the due dates, an additional charge will be

You must also pay electronically if you’re

added to your tax at a specified percentage

required to pay any Minnesota business tax

Information and Assistance

per year for the period of underpayment.

electronically, such as sales or withholding

Website:

tax.

Before You Can Make a Payment. To

Email:

insurance.taxes@state.mn.us

ensure your payment is processed correctly,

To pay electronically, go to the depart-

Phone:

651-556-3024

you must have a Minnesota tax ID number.

ment’s website at

This material is available in alter-

To register, go to

and log in to e-Services. If you do not have

nate formats.

or call 651-282-5225 or 1-800-657-3605.

Internet access, you can pay by phone at

1-800-570-3329. You’ll need your user name,

password and bank routing and account

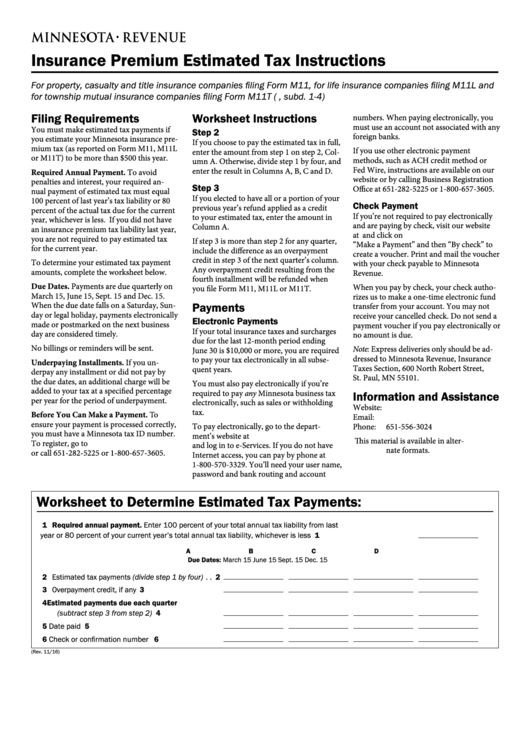

Worksheet to Determine Estimated Tax Payments:

1 Required annual payment. Enter 100 percent of your total annual tax liability from last

year or 80 percent of your current year’s total annual tax liability, whichever is less . . . . . . . . . . . . . . . . . . . . . . 1

A

B

C

D

Due Dates:

March 15

June 15

Sept . 15

Dec . 15

2 Estimated tax payments (divide step 1 by four) . . 2

3 Overpayment credit, if any . . . . . . . . . . . . . . . . . . . 3

4 Estimated payments due each quarter

(subtract step 3 from step 2) . . . . . . . . . . . . . . . . 4

5 Date paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Check or confirmation number . . . . . . . . . . . . . . . 6

(Rev . 11/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1