Instructions For Minnesota Annual Report Of Railroad Companies - Minnesota Department Of Revenue

ADVERTISEMENT

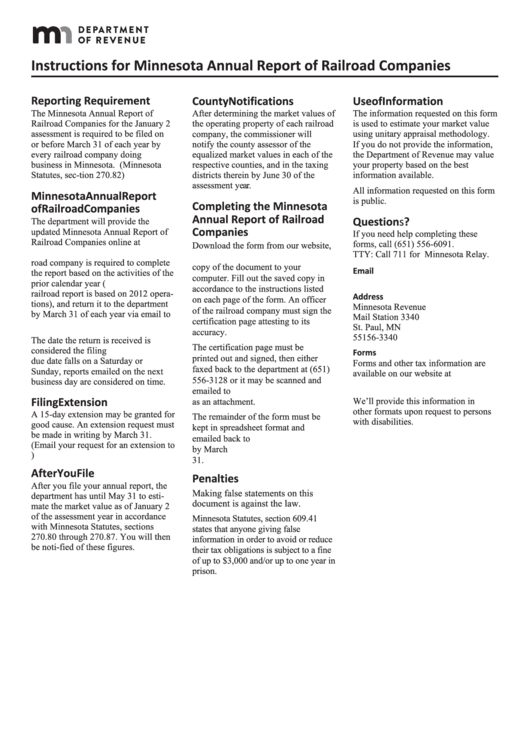

Instructions for Minnesota Annual Report of Railroad Companies

Reporting Requirement

County Notifications

Use of Information

The Minnesota Annual Report of

After determining the market values of

The information requested on this form

Railroad Companies for the January 2

the operating property of each railroad

is used to estimate your market value

assessment is required to be filed on

company, the commissioner will

using unitary appraisal methodology.

or before March 31 of each year by

notify the county assessor of the

If you do not provide the information,

every railroad company doing

equalized market values in each of the

the Department of Revenue may value

business in Minnesota. (Minnesota

respective counties, and in the taxing

your property based on the best

Statutes, sec-tion 270.82)

districts therein by June 30 of the

information available.

assessment year.

All information requested on this form

Minnesota Annual Report

is public.

Completing the Minnesota

of Railroad Companies

Annual Report of Railroad

Questions?

The department will provide the

Companies

updated Minnesota Annual Report of

If you need help completing these

Railroad Companies online at

forms, call (651) 556-6091.

Download the form from our website,

Each rail-

TTY: Call 711 for Minnesota Relay.

Save a

road company is required to complete

copy of the document to your

Email

the report based on the activities of the

computer. Fill out the saved copy in

sa.property@state.mn.us

prior calendar year (i.e. the 2013

accordance to the instructions listed

railroad report is based on 2012 opera-

Address

on each page of the form. An officer

tions), and return it to the department

Minnesota Revenue

of the railroad company must sign the

by March 31 of each year via email to

Mail Station 3340

certification page attesting to its

sa.property@state.mn.us.

St. Paul, MN

accuracy.

55156-3340

The date the return is received is

The certification page must be

considered the filing date.When the

Forms

printed out and signed, then either

due date falls on a Saturday or

Forms and other tax information are

faxed back to the department at (651)

Sunday, reports emailed on the next

available on our website at

556-3128 or it may be scanned and

business day are considered on time.

emailed to sa.property@state.mn.us

Filing Extension

We’ll provide this information in

as an attachment.

other formats upon request to persons

A 15-day extension may be granted for

The remainder of the form must be

with disabilities.

good cause. An extension request must

kept in spreadsheet format and

be made in writing by March 31.

emailed back to

(Email your request for an extension to

sa.property@state.mn.us by March

sa.property@state.mn.us.)

31.

After You File

Penalties

After you file your annual report, the

Making false statements on this

department has until May 31 to esti-

document is against the law.

mate the market value as of January 2

of the assessment year in accordance

Minnesota Statutes, section 609.41

with Minnesota Statutes, sections

states that anyone giving false

270.80 through 270.87. You will then

information in order to avoid or reduce

be noti-fied of these figures.

their tax obligations is subject to a fine

of up to $3,000 and/or up to one year in

prison.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1