Form D-407tc - Estates And Trusts Tax Credit Summary - 2014

ADVERTISEMENT

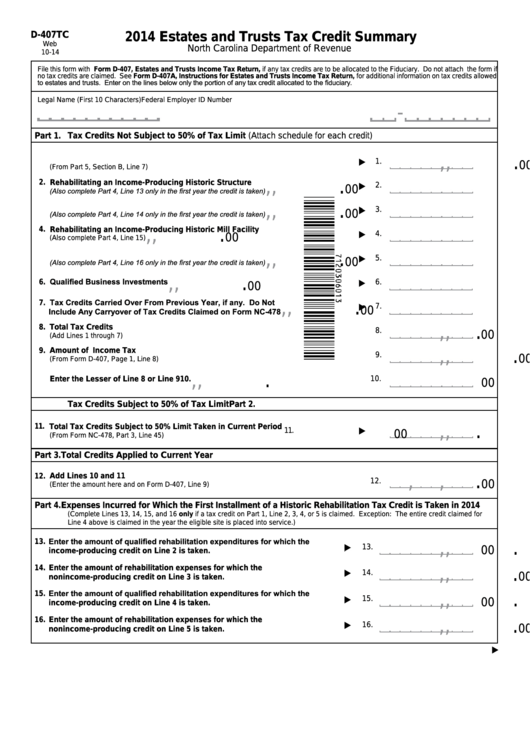

D-407TC

2014 Estates and Trusts Tax Credit Summary

Web

North Carolina Department of Revenue

10-14

File this form with Form D-407, Estates and Trusts Income Tax Return, if any tax credits are to be allocated to the Fiduciary. Do not attach the form if

no tax credits are claimed. See Form D-407A, Instructions for Estates and Trusts Income Tax Return, for additional information on tax credits allowed

to estates and trusts. Enter on the lines below only the portion of any tax credit allocated to the fiduciary.

Legal Name (First 10 Characters)

Federal Employer ID Number

Tax Credits Not Subject to 50% of Tax Limit (Attach schedule for each credit)

Part 1.

,

,

.

1. Credit for Tax Paid to Another State or Country

1.

00

(From Part 5, Section B, Line 7)

,

,

.

2. Rehabilitating an Income-Producing Historic Structure

2.

00

(Also complete Part 4, Line 13 only in the first year the credit is taken)

3. Rehabilitating a Nonincome-Producing Historic Structure

,

,

.

3.

00

(Also complete Part 4, Line 14 only in the first year the credit is taken)

4. Rehabilitating an Income-Producing Historic Mill Facility

,

,

.

4.

00

(Also complete Part 4, Line 15)

5. Rehabilitating a Nonincome-Producing Historic Mill Facility

,

,

.

5.

00

(Also complete Part 4, Line 16 only in the first year the credit is taken)

,

,

.

6. Qualified Business Investments

6.

00

7. Tax Credits Carried Over From Previous Year, if any. Do Not

,

,

.

7.

00

Include Any Carryover of Tax Credits Claimed on Form NC-478

8.

Total Tax Credits

,

,

.

8.

00

(Add Lines 1 through 7)

9.

Amount of Income Tax

,

,

.

9.

00

(From Form D-407, Page 1, Line 8)

,

,

.

10.

10.

Enter the Lesser of Line 8 or Line 9

00

Part 2.

Tax Credits Subject to 50% of Tax Limit

11. Total Tax Credits Subject to 50% Limit Taken in Current Period

,

,

.

11.

00

(From Form NC-478, Part 3, Line 45)

Part 3. Total Credits Applied to Current Year

12.

Add Lines 10 and 11

,

,

.

12.

00

(Enter the amount here and on Form D-407, Line 9)

Part 4. Expenses Incurred for Which the First Installment of a Historic Rehabilitation Tax Credit is Taken in 2014

(Complete Lines 13, 14, 15, and 16 only if a tax credit on Part 1, Line 2, 3, 4, or 5 is claimed. Exception: The entire credit claimed for

Line 4 above is claimed in the year the eligible site is placed into service.)

Enter the amount of qualified rehabilitation expenditures for which the

13.

,

,

.

13.

00

income-producing credit on Line 2 is taken.

14.

Enter the amount of rehabilitation expenses for which the

,

,

.

14.

00

nonincome-producing credit on Line 3 is taken.

Enter the amount of qualified rehabilitation expenditures for which the

15.

,

,

.

15.

00

income-producing credit on Line 4 is taken.

16.

Enter the amount of rehabilitation expenses for which the

,

,

.

16.

00

nonincome-producing credit on Line 5 is taken.

ADVERTISEMENT

0 votes

Related Articles

Related Categories

Parent category: Financial

1

1 2

2