Form 401 - Alcoholic Beverage Excise Tax License Application

ADVERTISEMENT

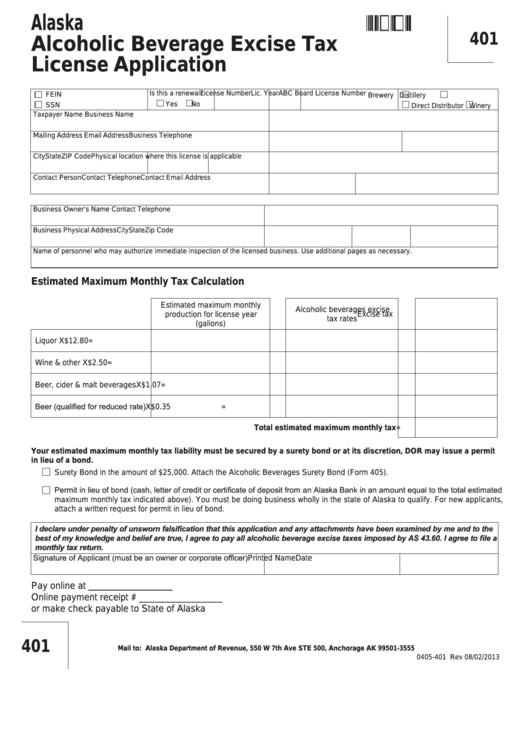

Alaska

401:08 02 13

401

Alcoholic Beverage Excise Tax

License Application

Is this a renewal?

License Number Lic. Year ABC Board License Number

FEIN

Brewery

Distillery

Yes

No

SSN

Direct Distributor

Winery

Taxpayer Name

Business Name

Mailing Address

Email Address

Business Telephone

City

State

ZIP Code

Physical location where this license is applicable

Contact Person

Contact Telephone

Contact Email Address

Business Owner’s Name

Contact Telephone

Business Physical Address

City

State

Zip Code

Name of personnel who may authorize immediate inspection of the licensed business. Use additional pages as necessary.

Estimated Maximum Monthly Tax Calculation

Estimated maximum monthly

Alcoholic beverages excise

production for license year

Excise tax

tax rates

(gallons)

Liquor

X

$12.80

=

Wine & other

X

$2.50

=

Beer, cider & malt beverages

X

$1.07

=

Beer (qualified for reduced rate)

X

$0.35

=

Total estimated maximum monthly tax

=

Your estimated maximum monthly tax liability must be secured by a surety bond or at its discretion, DOR may issue a permit

in lieu of a bond.

Surety Bond in the amount of $25,000. Attach the Alcoholic Beverages Surety Bond (Form 405).

Permit in lieu of bond (cash, letter of credit or certificate of deposit from an Alaska Bank in an amount equal to the total estimated

maximum monthly tax indicated above). You must be doing business wholly in the state of Alaska to qualify. For new applicants,

attach a written request for permit in lieu of bond.

I declare under penalty of unsworn falsification that this application and any attachments have been examined by me and to the

best of my knowledge and belief are true, I agree to pay all alcoholic beverage excise taxes imposed by AS 43.60. I agree to file a

monthly tax return.

Signature of Applicant (must be an owner or corporate officer)

Printed Name

Date

Pay online at

Online payment receipt # ________________

or make check payable to State of Alaska

401

Mail to: Alaska Department of Revenue, 550 W 7th Ave STE 500, Anchorage AK 99501-3555

0405-401 Rev 08/02/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1