Form Dr-189 Draft - Application For Fuel Tax Refund Municipalities, Counties And School Districts

ADVERTISEMENT

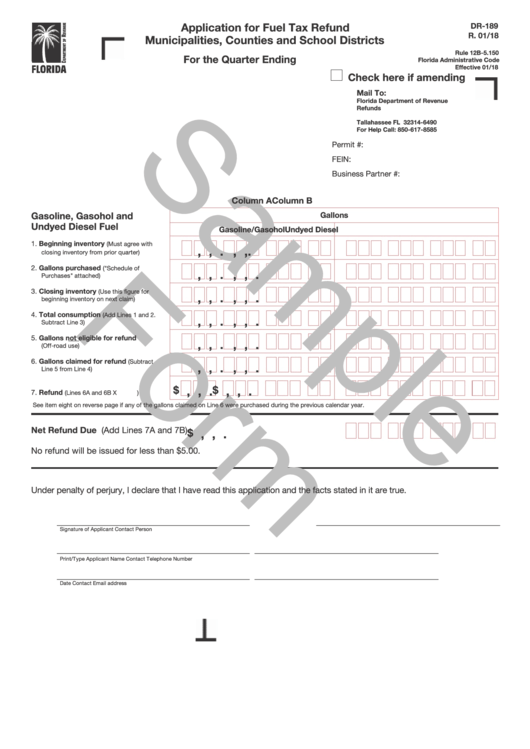

Application for Fuel Tax Refund

DR-189

R. 01/18

Municipalities, Counties and School Districts

Rule 12B-5.150

For the Quarter Ending

Florida Administrative Code

Effective 01/18

Check here if amending

Mail To:

Florida Department of Revenue

Refunds

P.O. Box 6490

Tallahassee FL 32314-6490

For Help Call: 850-617-8585

Permit #:

FEIN:

Business Partner #:

Column A

Column B

Gasoline, Gasohol and

Gallons

Undyed Diesel Fuel

Gasoline/Gasohol

Undyed Diesel

1. Beginning inventory

(Must agree with

,

,

.

,

,

.

closing inventory from prior quarter) ..............

2. Gallons purchased

("Schedule of

,

,

.

,

,

.

Purchases" attached) .....................................

3. Closing inventory

(Use this figure for

,

,

.

,

,

.

beginning inventory on next claim) ................

4. Total consumption

(Add Lines 1 and 2.

,

,

.

,

,

.

Subtract Line 3) ..............................................

5. Gallons not eligible for refund

,

,

.

,

,

.

(Off-road use) .................................................

6. Gallons claimed for refund

(Subtract

,

,

.

,

,

.

Line 5 from Line 4) ..........................................

$

,

,

.

$

,

,

.

7. Refund

(Lines 6A and 6B X

.1 4

1) .............

See item eight on reverse page if any of the gallons claimed on Line 6 were purchased during the previous calendar year.

Net Refund Due (Add Lines 7A and 7B)

$

,

,

.

No refund will be issued for less than $5.00.

Under penalty of perjury, I declare that I have read this application and the facts stated in it are true.

____________________________________________

__________________________________________

Signature of Applicant

Contact Person

____________________________________________

__________________________________________

Print/Type Applicant Name

Contact Telephone Number

____________________________________________

__________________________________________

Date

Contact Email address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3