DR 0449 (02/08/12)

COLORADO DEPARTMENT OF REVENUE

DENVER, CO 80261-0009

303-205-8211 ext 6848

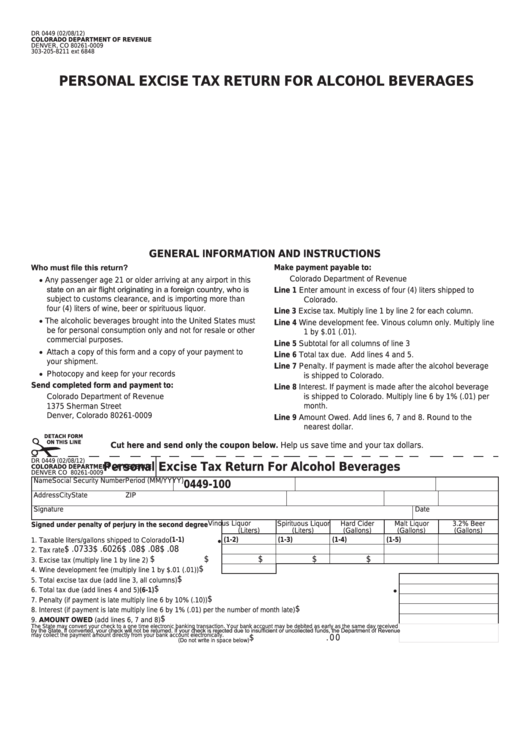

PERSONAL EXCISE TAX RETURN FOR ALCOHOL BEVERAGES

GENERAL INFORMATION AND INSTRUCTIONS

Who must file this return?

Make payment payable to:

•

Colorado Department of Revenue

Any passenger age 21 or older arriving at any airport in this

state on an air flight originating in a foreign country, who is

Line 1 Enter amount in excess of four (4) liters shipped to

subject to customs clearance, and is importing more than

Colorado.

four (4) liters of wine, beer or spirituous liquor.

Line 3 Excise tax. Multiply line 1 by line 2 for each column.

•

The alcoholic beverages brought into the United States must

Line 4 Wine development fee. Vinous column only. Multiply line

be for personal consumption only and not for resale or other

1 by $.01 (.01).

commercial purposes.

Line 5 Subtotal for all columns of line 3

•

Attach a copy of this form and a copy of your payment to

Line 6 Total tax due. Add lines 4 and 5.

your shipment.

Line 7 Penalty. If payment is made after the alcohol beverage

•

Photocopy and keep for your records

is shipped to Colorado.

Send completed form and payment to:

Line 8 Interest. If payment is made after the alcohol beverage

Colorado Department of Revenue

is shipped to Colorado. Multiply line 6 by 1% (.01) per

1375 Sherman Street

month.

Denver, Colorado 80261-0009

Line 9 Amount Owed. Add lines 6, 7 and 8. Round to the

nearest dollar.

DETACH FORM

ON THIS LINE

Cut here and send only the coupon below. Help us save time and your tax dollars.

DR 0449 (02/08/12)

Personal Excise Tax Return For Alcohol Beverages

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0009

Name

Social Security Number

Period (MM/YYYY)

0449-100

Address

City

State

ZIP

Signature

Date

Vinous Liquor

Spirituous Liquor

Hard Cider

Malt Liquor

3.2% Beer

Signed under penalty of perjury in the second degree

(Liters)

(Liters)

(Gallons)

(Gallons)

(Gallons)

1. Taxable liters/gallons shipped to Colorado ......................... (1-1)

(1-2)

(1-3)

(1-4)

(1-5)

$ .0733

$ .6026

$ .08

$ .08

$ .08

2. Tax rate ...............................................................................

$

$

$

$

$

3. Excise tax (multiply line 1 by line 2)....................................

$

4. Wine development fee (multiply line 1 by $.01 (.01)) .........

$

5. Total excise tax due (add line 3, all columns) .................................................................................................................

$

6. Total tax due (add lines 4 and 5) ........................................................................................................................... (6-1)

$

7. Penalty (if payment is late multiply line 6 by 10% (.10)) .................................................................................................

$

8. Interest (if payment is late multiply line 6 by 1% (.01) per the number of month late) ....................................................

$

9. AMOUNT OWED (add lines 6, 7 and 8) .........................................................................................................................

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received

by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue

may collect the payment amount directly from your bank account electronically.

$

. 0 0

(Do not write in space below)

1

1