Form Dr 1102 - Address Change Or Business Closure Form

ADVERTISEMENT

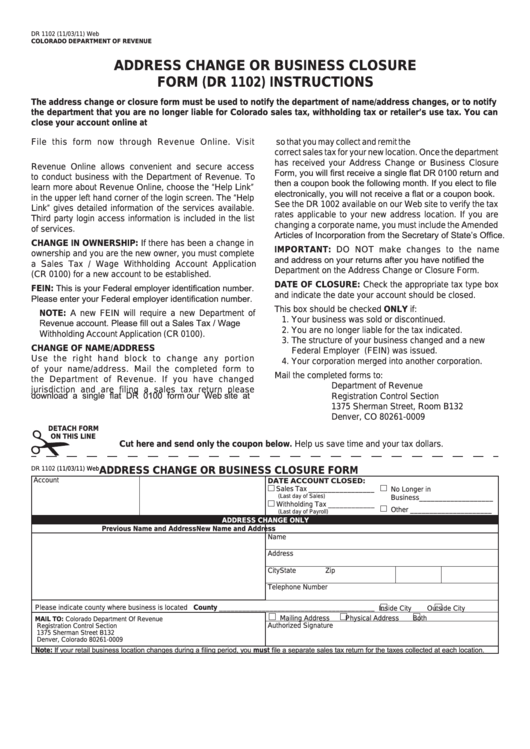

DR 1102 (11/03/11) Web

COLORADO DEPARTMENT OF REVENUE

ADDRESS CHANGE OR BUSINESS CLOSURE

FORM (DR 1102) INSTRUCTIONS

The address change or closure form must be used to notify the department of name/address changes, or to notify

the department that you are no longer liable for Colorado sales tax, withholding tax or retailer’s use tax. you can

close your account online at

File this form now through Revenue Online. Visit

so that you may collect and remit the

correct sales tax for your new location. Once the department

has received your Address Change or Business Closure

Revenue Online allows convenient and secure access

Form, you will first receive a single flat DR 0100 return and

to conduct business with the Department of Revenue. To

then a coupon book the following month. If you elect to file

learn more about Revenue Online, choose the “Help Link”

electronically, you will not receive a flat or a coupon book.

in the upper left hand corner of the login screen. The “Help

See the DR 1002 available on our Web site to verify the tax

Link” gives detailed information of the services available.

rates applicable to your new address location. If you are

Third party login access information is included in the list

changing a corporate name, you must include the Amended

of services.

Articles of Incorporation from the Secretary of State’s Office.

CHANGE IN OWNERSHIP: If there has been a change in

IMPORTANT: DO NOT make changes to the name

ownership and you are the new owner, you must complete

and address on your returns after you have notified the

a Sales Tax / Wage Withholding Account Application

Department on the Address Change or Closure Form.

(CR 0100) for a new account to be established.

DATE OF CLOSURE: Check the appropriate tax type box

FEIN: This is your Federal employer identification number.

and indicate the date your account should be closed.

Please enter your Federal employer identification number.

This box should be checked ONLy if:

NOTE: A new FEIN will require a new Department of

1. Your business was sold or discontinued.

Revenue account. Please fill out a Sales Tax / Wage

2. You are no longer liable for the tax indicated.

Withholding Account Application (CR 0100).

3. The structure of your business changed and a new

CHANGE OF NAME/ADDRESS

Federal Employer I.D. Number (FEIN) was issued.

Use the right hand block to change any portion

4. Your corporation merged into another corporation.

of your name/address. Mail the completed form to

Mail the completed forms to:

the Department of Revenue. If you have changed

Department of Revenue

jurisdiction and are filing a sales tax return please

Registration Control Section

download a single flat DR 0100 form our Web site at

1375 Sherman Street, Room B132

Denver, CO 80261-0009

DETACH FORM

ON THIS LINE

Cut here and send only the coupon below. Help us save time and your tax dollars.

DR 1102

(11/03/11) Web

ADDRESS CHANGE OR BUSINESS CLOSURE FORM

Account No.

FEIN

DATE ACCOUNT CLOSED:

Sales Tax _________________

No Longer in

(Last day of Sales)

Business___________________

Withholding Tax ____________

Other _____________________

(Last day of Payroll)

ADDRESS CHANGE ONLy

Previous Name and Address

New Name and Address

Name

Address

City

State

Zip

Telephone Number

Please indicate county where business is located County ________________________________________

Inside City

Outside City

Mailing Address

Physical Address

Both

MAIL TO:

Colorado Department Of Revenue

Authorized Signature

Registration Control Section

1375 Sherman Street B132

Denver, Colorado 80261-0009

Note: If your retail business location changes during a filing period, you must file a separate sales tax return for the taxes collected at each location.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1