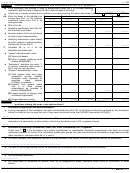

Sample Form 990-Pf - Return Of Private Foundation - 2015 Page 9

ADVERTISEMENT

9

Form 990-PF (2015)

Page

Part XIII

Undistributed Income (see instructions)

(a)

(b)

(c)

(d)

Corpus

Years prior to 2014

2014

2015

1

Distributable amount for 2015 from Part XI,

line 7

.

.

.

.

.

.

.

.

.

.

.

.

.

0

2

Undistributed income, if any, as of the end of 2015:

a Enter amount for 2014 only .

.

.

.

.

.

0

b Total for prior years: 20

,20

,20

0

3

Excess distributions carryover, if any, to 2015:

a From 2010

.

.

.

.

.

.

0

b From 2011

.

.

.

.

.

.

0

c From 2012

.

.

.

.

.

.

0

d From 2013

.

.

.

.

.

.

0

e From 2014

.

.

.

.

.

.

0

f

Total of lines 3a through e .

.

.

.

.

.

0

4

Qualifying distributions for 2015 from Part XII,

line 4:

$

▶

207838

a Applied to 2014, but not more than line 2a .

0

b Applied to undistributed income of prior years

(Election required—see instructions) .

.

.

0

c Treated as distributions out of corpus (Election

required—see instructions) .

.

.

.

.

.

0

d Applied to 2015 distributable amount

.

.

207838

e Remaining amount distributed out of corpus

5

Excess distributions carryover applied to 2015

0

(If an amount appears in column (d), the same

amount must be shown in column (a).)

6

Enter the net total of each column as

indicated below:

a Corpus. Add lines 3f, 4c, and 4e. Subtract line 5

0

b Prior years’ undistributed income. Subtract

line 4b from line 2b

.

.

.

.

.

.

.

.

0

c Enter the amount of prior years’ undistributed

income for which a notice of deficiency has

been issued, or on which the section 4942(a)

tax has been previously assessed .

.

.

.

0

d Subtract line 6c from line 6b. Taxable

amount—see instructions

.

.

.

.

.

.

0

e Undistributed income for 2014. Subtract line

4a

from

line

2a.

Taxable

amount—see

instructions .

.

.

.

.

.

.

.

.

.

.

0

f

Undistributed income for 2015. Subtract lines

4d and 5 from line 1. This amount must be

distributed in 2016 .

.

.

.

.

.

.

.

.

0

7

Amounts treated as distributions out of corpus

to satisfy requirements imposed by section

170(b)(1)(F) or 4942(g)(3) (Election may be

required—see instructions) .

.

.

.

.

.

0

8

Excess distributions carryover from 2010 not

applied on line 5 or line 7 (see instructions) .

0

9

Excess distributions carryover to 2016.

Subtract lines 7 and 8 from line 6a

.

.

.

0

Analysis of line 9:

10

a Excess from 2011 .

.

.

.

0

b Excess from 2012 .

.

.

.

0

c Excess from 2013 .

.

.

.

0

d Excess from 2014 .

.

.

.

0

e Excess from 2015 .

.

.

.

0

990-PF

Form

(2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13