Sample Form 990-Pf - Return Of Private Foundation - 2015 Page 7

ADVERTISEMENT

7

Form 990-PF (2015)

Page

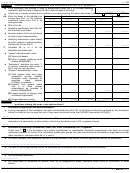

Part VIII

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

3

Five highest-paid independent contractors for professional services (see instructions). If none, enter “NONE.”

(a) Name and address of each person paid more than $50,000

(b) Type of service

(c) Compensation

NONE

Total number of others receiving over $50,000 for professional services

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Part IX-A

Summary of Direct Charitable Activities

List the foundation’s four largest direct charitable activities during the tax year. Include relevant statistical information such as the number of

Expenses

organizations and other beneficiaries served, conferences convened, research papers produced, etc.

1

St. Teresa's Catholic Church and School - St. Teresa's Catholic Church, supporting both the church's activities

for fund raising for student scholarships to their school and providing two educational scholarships.

41450

2

K of C Council 3607 Catholic family men faith based organization that provides support for families,

churches, and community through the principles of charity and patriotism.

22460

3

K of C Assembly 478 Catholic family men faith based organization that provides support for families,

churches, and community through the principles of charity and patriotism.

4840

4

ALL OTHER PROGRAMS TOTAL, Southwest Georgia Council for Senior Citizens, Habitat for Humanity, etc.

14540

Part IX-B

Summary of Program-Related Investments (see instructions)

Amount

Describe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2.

1

2

All other program-related investments. See instructions.

3

Total. Add lines 1 through 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

990-PF

Form

(2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13