Sample Form 990-Pf - Return Of Private Foundation - 2015 Page 3

ADVERTISEMENT

3

Form 990-PF (2015)

Page

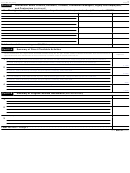

Part IV

Capital Gains and Losses for Tax on Investment Income

(b) How acquired

(a) List and describe the kind(s) of property sold (e.g., real estate,

(c) Date acquired

(d) Date sold

P—Purchase

2-story brick warehouse; or common stock, 200 shs. MLC Co.)

(mo., day, yr.)

(mo., day, yr.)

D—Donation

1a

none

b

c

d

e

(f) Depreciation allowed

(g) Cost or other basis

(h) Gain or (loss)

(e) Gross sales price

(or allowable)

plus expense of sale

(e) plus (f) minus (g)

a

none

b

c

d

e

Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69

(l) Gains (Col. (h) gain minus

col. (k), but not less than -0-) or

(j) Adjusted basis

(k) Excess of col. (i)

(i) F.M.V. as of 12/31/69

Losses (from col. (h))

as of 12/31/69

over col. (j), if any

a

none

b

c

d

e

{

}

If gain, also enter in Part I, line 7

2

Capital gain net income or (net capital loss)

If (loss), enter -0- in Part I, line 7

2

0

3

Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):

}

If gain, also enter in Part I, line 8, column (c) (see instructions). If (loss), enter -0- in

Part I, line 8 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

0

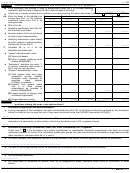

Part V

Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank.

Yes

No

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period?

If “Yes,” the foundation does not qualify under section 4940(e). Do not complete this part.

1

Enter the appropriate amount in each column for each year; see the instructions before making any entries.

(a)

(d)

(b)

(c)

Base period years

Distribution ratio

Adjusted qualifying distributions

Net value of noncharitable-use assets

Calendar year (or tax year beginning in)

(col. (b) divided by col. (c))

2014

0

0

0

2013

0

0

0

2012

0

0

0

2011

0

0

0

2010

0

0

0

2

Total of line 1, column (d)

2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0

3

Average distribution ratio for the 5-year base period—divide the total on line 2 by 5, or by the

number of years the foundation has been in existence if less than 5 years

.

.

.

.

.

.

3

0

4

4

Enter the net value of noncharitable-use assets for 2015 from Part X, line 5 .

.

.

.

.

.

0

5

Multiply line 4 by line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

0

6

Enter 1% of net investment income (1% of Part I, line 27b)

.

.

.

.

.

.

.

.

.

.

.

6

0

7

7

Add lines 5 and 6 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0

8

Enter qualifying distributions from Part XII, line 4 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

0

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate. See the

Part VI instructions.

990-PF

Form

(2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13