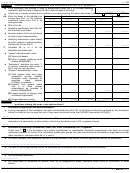

Sample Form 990-Pf - Return Of Private Foundation - 2015 Page 2

ADVERTISEMENT

2

Form 990-PF (2015)

Page

Beginning of year

End of year

Attached schedules and amounts in the description column

Part II

Balance Sheets

should be for end-of-year amounts only. (See instructions.)

(a) Book Value

(b) Book Value

(c) Fair Market Value

1

Cash—non-interest-bearing

.

.

.

.

.

.

.

.

.

.

.

15413

31028

31028

2

Savings and temporary cash investments .

.

.

.

.

.

.

3

Accounts receivable

▶

Less: allowance for doubtful accounts

▶

4

Pledges receivable

▶

Less: allowance for doubtful accounts

▶

5

Grants receivable .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see instructions)

.

.

7

Other notes and loans receivable (attach schedule)

▶

Less: allowance for doubtful accounts

300

300

300

▶

8

Inventories for sale or use .

.

.

.

.

.

.

.

.

.

.

.

9

Prepaid expenses and deferred charges

.

.

.

.

.

.

.

10000

16335

31028

10a Investments—U.S. and state government obligations (attach schedule)

b Investments—corporate stock (attach schedule) .

.

.

.

.

c Investments—corporate bonds (attach schedule)

.

.

.

.

11

Investments—land, buildings, and equipment: basis

▶

Less: accumulated depreciation (attach schedule)

▶

12

Investments—mortgage loans .

.

.

.

.

.

.

.

.

.

.

13

Investments—other (attach schedule)

.

.

.

.

.

.

.

.

14

Land, buildings, and equipment: basis

575088

▶

Less: accumulated depreciation (attach schedule)

460119

▶

124255

144968

250000

15

)

Other assets (describe

▶

16

Total assets (to be completed by all filers—see the

instructions. Also, see page 1, item I)

.

.

.

.

.

.

.

.

149968

162631

267663

17

Accounts payable and accrued expenses .

.

.

.

.

.

.

1049

890

18

Grants payable .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

Deferred revenue .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12685

25704

20

Loans from officers, directors, trustees, and other disqualified persons

21

Mortgages and other notes payable (attach schedule) .

.

.

22

)

Other liabilities (describe

69586

60172

▶

Total liabilities (add lines 17 through 22) .

.

.

.

.

.

.

23

83320

86766

Foundations that follow SFAS 117, check here

.

.

▶

and complete lines 24 through 26 and lines 30 and 31.

24

Unrestricted .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

25

Temporarily restricted

.

.

.

.

.

.

.

.

.

.

.

.

.

26

Permanently restricted

.

.

.

.

.

.

.

.

.

.

.

.

.

Foundations that do not follow SFAS 117, check here

▶

and complete lines 27 through 31.

27

Capital stock, trust principal, or current funds .

.

.

.

.

.

28

Paid-in or capital surplus, or land, bldg., and equipment fund

29

Retained earnings, accumulated income, endowment, or other funds

66648

75865

30

Total net assets or fund balances (see instructions) .

.

.

66648

75865

31

Total

liabilities

and

net

assets/fund

balances

(see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

149968

162631

Part III

Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year—Part II, column (a), line 30 (must agree with

end-of-year figure reported on prior year’s return) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

66648

2 Enter amount from Part I, line 27a

2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9217

3 Other increases not included in line 2 (itemize)

3

▶

4 Add lines 1, 2, and 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

75865

5 Decreases not included in line 2 (itemize)

5

▶

6 Total net assets or fund balances at end of year (line 4 minus line 5)—Part II, column (b), line 30 .

.

6

75865

990-PF

Form

(2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13