Sample Form 990-Pf - Return Of Private Foundation - 2015 Page 12

ADVERTISEMENT

12

Form 990-PF (2015)

Page

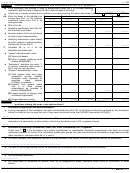

Part XVI-A

Analysis of Income-Producing Activities

Unrelated business income

Excluded by section 512, 513, or 514

Enter gross amounts unless otherwise indicated.

(e)

Related or exempt

(a)

(b)

(c)

(d)

function income

Business code

Amount

Exclusion code

Amount

(See instructions.)

1 Program service revenue:

a

Community Healthcare/Education Support

6260

b

Community Patriotism

2090

c

d

e

f

g Fees and contracts from government agencies

2 Membership dues and assessments

.

.

.

.

3 Interest on savings and temporary cash investments

5

4 Dividends and interest from securities .

.

.

.

5 Net rental income or (loss) from real estate:

a Debt-financed property

.

.

.

.

.

.

.

b

Not debt-financed property

.

.

.

.

.

.

532000

173866

0

173866

6 Net rental income or (loss) from personal property

7 Other investment income .

.

.

.

.

.

.

.

8 Gain or (loss) from sales of assets other than inventory

9 Net income or (loss) from special events .

.

.

10 Gross profit or (loss) from sales of inventory .

.

722320

44121

0

44121

11 Other revenue: a

b

c

d

e

12 Subtotal. Add columns (b), (d), and (e) .

.

.

.

217987

0

217987

13 Total. Add line 12, columns (b), (d), and (e)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

217987

(See worksheet in line 13 instructions to verify calculations.)

Part XVI-B

Relationship of Activities to the Accomplishment of Exempt Purposes

Line No.

Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to the

accomplishment of the foundation’s exempt purposes (other than by providing funds for such purposes). (See instructions.)

▼

1

Restricted Donations Educational Expenses/Veterans Services

3

All funds generated less expenses provide the facilities used by charitable organizations for charitable purposes

5

All funds generated less expenses provide the facilities used by charitable organizations for charitable purposes

9

All funds generated less expenses provide the facilities used by charitable organizations for charitable purposes

10

All funds generated less expenses provide the facilities used by charitable organizations for charitable purposes

11

All funds generated less expenses provide the facilities used by charitable organizations for charitable purposes

990-PF

Form

(2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13