Bccd Form 2 - Annual License Fee Return

ADVERTISEMENT

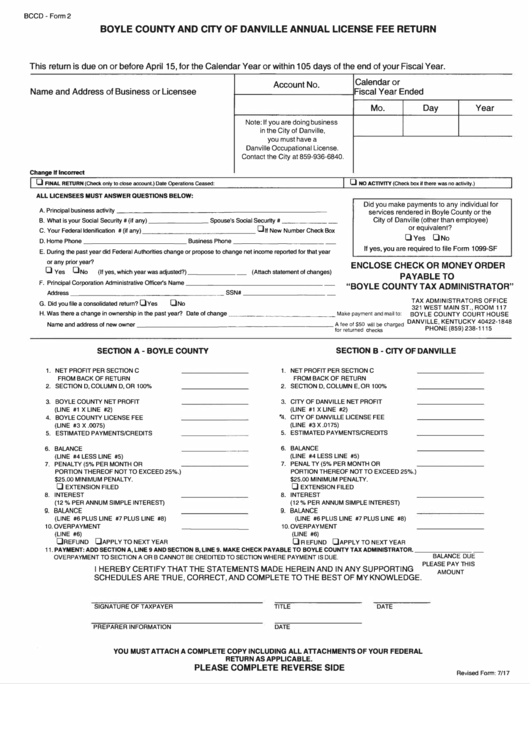

BCCD- Form 2

BOYLE COUNTY AND CITY OF DANVILLE ANNUAL LICENSE FEE RETURN

This return is due on or before April 15, for the Calendar Year or within 105 days of the end of your Fiscal Year.

Calendar or

Account No.

Name and Address of Business or Licensee

Fiscal Year Ended

Mo.

Year

Day

Note: If you are doing business

in the City of Danville,

you must have a

Danville Occupational License.

Contact the City at 859-936-6840.

Chan g e If Incorrect

0

0

FINAL RETURN (Check only to ciose account.) Date Operations Ceased:

NO ACTIVITY (Check box if there was no activity.)

ALL LICENSEES MUST ANSWER QUESTIONS BELOW:

Did you make payments to any individual for

A. Principal business activity _____________ _________ _

services rendered in Boyle County or the

City of Danville (other than employee)

B. What is your Social Security# (if any) _______ Spouse's Social Security# _____ _

or equivalent?

0 11 New Number Check Box

C. Your Federal ldenification # (if any)

Oves

ONo

D. Home Phone ___________ Business Phone __________ _

If yes, you are required to file Form 1099-SF

E. During the past year did Federal Authorities change or propose to change net income reported for that year

or any prior year?

ENCLOSE CHECK OR MONEY ORDER

0 Yes

DNo

(If yes, which year was adjusted?) _____ _ (Attach statement of changes)

PAYABLE TO

F. Principal Corporation Administrative Officer's Name _______________ _

"BOYLE COUNTY TAX ADMINISTRATOR"

Address _____ _ _ __________ SSN # ______ _ _ _ _

TAX ADMINISTRATORS OFFICE

G. Did you file a consolidated return? 0Yes

0No

321 WEST MAIN ST., ROOM 117

H. Was there a change in ownership in the past year? Date of change ____________ Make payment and mail to:

BOYLE COUNTY COURT HOUSE

DANVILLE, KENTUCKY 40422-1848

i �! ; c h a rg ed

Name and address of new owner ___________________ ___ �) �:

t � ;:;� c �

PHONE (859) 238-1115

SECTION A - BOYLE COUNTY

SECTION B - CITY OF DANVILLE

1. NET PROFIT PER SECTION C

1. NET PROFIT PER SECTION C

FROM BACK OF RETURN

FROM BACK OF RETURN

2. SECTION D, COLUMN D, OR 100%

2. SECTION D, COLUMN E, OR 100%

3. BOYLE COUNTY NET PROFIT

3. CITY OF DANVILLE NET PROFIT

(LINE #1 X LINE #2)

(LINE #1 X LINE #2)

4. BOYLE COUNTY LICENSE FEE

*4. CITY OF DANVILLE LICENSE FEE

(LINE #3 X .0075)

(LINE #3 X .0175)

5. ESTIMATED PAYMENTS/CREDITS

5. ESTIMATED PAYMENTS/CREDITS

6. BALANCE

6. BALANCE

(LINE #4 LESS LINE #5)

(LINE #4 LESS LINE #5)

7. PENALTY (5% PER MONTH OR

7. PENAL TY (5% PER MONTH OR

PORTION THEREOF NOT TO EXCEED 25%.)

PORTION THEREOF NOT TO EXCEED 25%.)

$25.00 MINIMUM PENALTY.

$25.00 MINIMUM PENALTY.

0

0

EXTENSION FILED

EXTENSION FILED

8. INTEREST

8. INTEREST

(12 % PER ANNUM SIMPLE INTEREST)

(12 % PER ANNUM SIMPLE INTEREST)

9. BALANCE

9. BALANCE

(LINE #6 PLUS LINE #7 PLUS LINE #8)

(LINE #6 PLUS LINE #7 PLUS LINE #8)

10.0VERPAYMENT

_______

10.0VERPAYMENT

(LINE #6)

(LINE #6)

0REFUND

0APPLY TO NEXT YEAR

0 REFUND 0APPLY TO NEXT YEAR

11. PAYMENT: ADD SECTION A , LINE 9 AND SECTION B , LINE 9. MAKE CHECK PAYABLE TO BOYLE COUNTY TAX ADMINISTRATOR. ______ _

BALANCE DUE

OVERPAYMENT TO SECTION A OR B CANNOT BE CREDITED TO SECTION WHERE PAYMENT IS DUE.

PLEASE PAY THIS

I HEREBY CERTIFY THAT THE STATEMENTS MADE HEREIN AND IN ANY SUPPORTING

AMOUNT

SCHEDULES ARE TRUE, CORRECT, AND COMPLETE TO THE BEST OF MY KNOWLEDGE.

SIGNATURE OF TAXPAYER

TITLE

DATE

DATE

PREPARER INFORMATION

YOU MUST ATTACH A COMPLETE COPY INCLUDING ALL ATTACHMENTS OF YOUR FEDERAL

RETURN AS APPLICABLE.

PLEASE COMPLETE REVERSE SIDE

Revised Form: 7/17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2