Form Gas - Gasoline Distributor Tax Return - Maine Revenue Services

ADVERTISEMENT

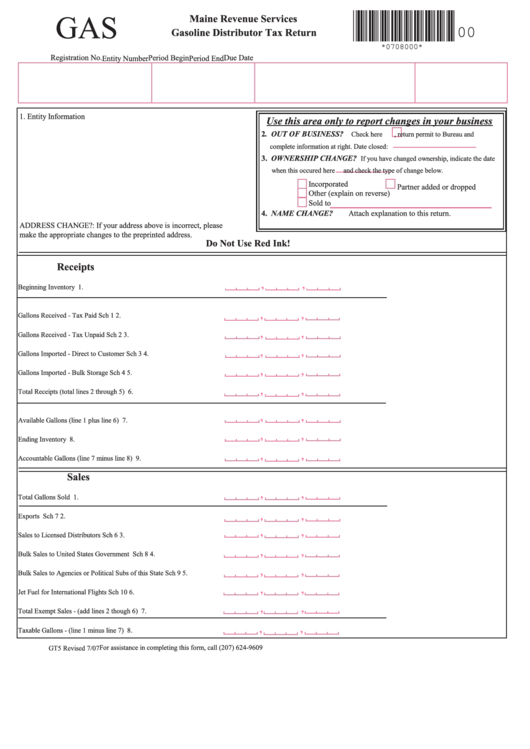

GAS

Maine Revenue Services

00

Gasoline Distributor Tax Return

*0708000*

Registration No.

Period Begin

Due Date

Entity Number

Period End

1. Entity Information

Use this area only to report changes in your business

2. OUT OF BUSINESS?

Check here

, return permit to Bureau and

complete information at right. Date closed:

3. OWNERSHIP CHANGE?

If you have changed ownership, indicate the date

when this occured here

and check the type of change below.

Incorporated

Partner added or dropped

Other (explain on reverse)

Sold to

4. NAME CHANGE?

Attach explanation to this return.

ADDRESS CHANGE?: If your address above is incorrect, please

make the appropriate changes to the preprinted address.

Do Not Use Red Ink!

Receipts

,

,

Beginning Inventory

1.

,

,

Gallons Received - Tax Paid

Sch 1

2.

,

,

Gallons Received - Tax Unpaid

Sch 2

3.

,

,

Gallons Imported - Direct to Customer

Sch 3

4.

,

,

Gallons Imported - Bulk Storage

Sch 4

5.

,

,

Total Receipts (total lines 2 through 5)

6.

,

,

Available Gallons (line 1 plus line 6)

7.

,

,

Ending Inventory

8.

,

,

Accountable Gallons (line 7 minus line 8)

9.

Sales

,

,

Total Gallons Sold

1.

,

,

Exports

Sch 7

2.

,

,

Sales to Licensed Distributors

Sch 6

3.

,

,

Bulk Sales to United States Government

Sch 8

4.

,

,

Bulk Sales to Agencies or Political Subs of this State

Sch 9

5.

,

,

Jet Fuel for International Flights

Sch 10

6.

,

,

Total Exempt Sales - (add lines 2 though 6)

7.

,

,

Taxable Gallons - (line 1 minus line 7)

8.

For assistance in completing this form, call (207) 624-9609

GT5 Revised 7/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2