Clear Form

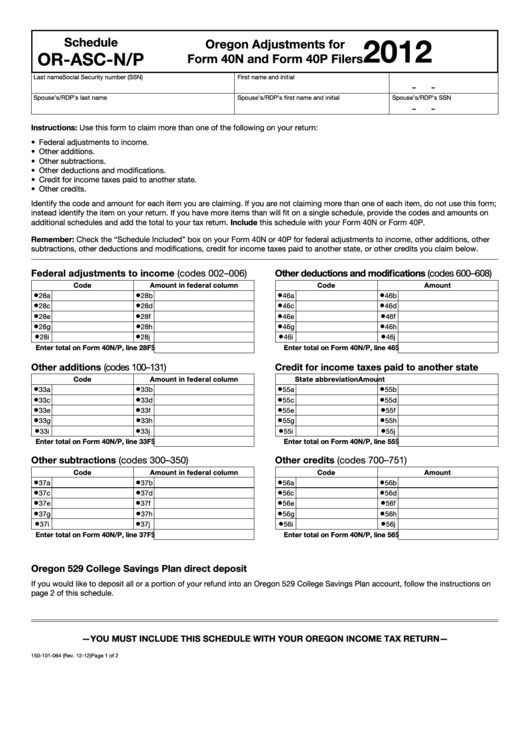

2012

Schedule

Oregon Adjustments for

OR-ASC-N/P

Form 40N and Form 40P Filers

Last name

First name and initial

Social Security number (SSN)

–

–

Spouse’s/RDP’s last name

Spouse’s/RDP’s first name and initial

Spouse’s/RDP’s SSN

–

–

Instructions: Use this form to claim more than one of the following on your return:

• Federal adjustments to income.

• Other additions.

• Other subtractions.

• Other deductions and modifications.

• Credit for income taxes paid to another state.

• Other credits.

Identify the code and amount for each item you are claiming. If you are not claiming more than one of each item, do not use this form;

instead identify the item on your return. If you have more items than will fit on a single schedule, provide the codes and amounts on

additional schedules and add the total to your tax return. Include this schedule with your Form 40N or Form 40P.

Remember: Check the “Schedule Included” box on your Form 40N or 40P for federal adjustments to income, other additions, other

subtractions, other deductions and modifications, credit for income taxes paid to another state, or other credits you claim below.

Federal adjustments to income (codes 002–006)

Other deductions and modifications (codes 600–608)

Code

Amount in federal column

Code

Amount

•

•

•

•

28a

28b

46a

46b

•

•

•

•

28c

28d

46c

46d

•

•

•

•

28e

28f

46e

46f

•

•

•

•

28g

28h

46g

46h

•

•

•

•

28i

28j

46i

46j

Enter total on Form 40N/P, line 28F $

Enter total on Form 40N/P, line 46 $

Other additions (codes 100–131)

Credit for income taxes paid to another state

Code

Amount in federal column

State abbreviation

Amount

•

•

•

•

33a

33b

55a

55b

•

•

•

•

33c

33d

55c

55d

•

•

•

•

33e

33f

55e

55f

•

•

•

•

33g

33h

55g

55h

•

•

•

•

33i

33j

55i

55j

Enter total on Form 40N/P, line 33F $

Enter total on Form 40N/P, line 55 $

Other subtractions (codes 300–350)

Other credits (codes 700–751)

Code

Amount in federal column

Code

Amount

•

•

•

•

37a

37b

56a

56b

•

•

•

•

37c

37d

56c

56d

•

•

•

•

37e

37f

56e

56f

•

•

•

•

37g

37h

56g

56h

•

•

•

•

37i

37j

56i

56j

Enter total on Form 40N/P, line 37F $

Enter total on Form 40N/P, line 56 $

Oregon 529 College Savings Plan direct deposit

If you would like to deposit all or a portion of your refund into an Oregon 529 College Savings Plan account, follow the instructions on

page 2 of this schedule.

—YOU MUST INCLUDE THIS SCHEDULE WITH YOUR OREGON INCOME TAX RETURN—

150-101-064 (Rev. 12-12)

Page 1 of 2

1

1 2

2