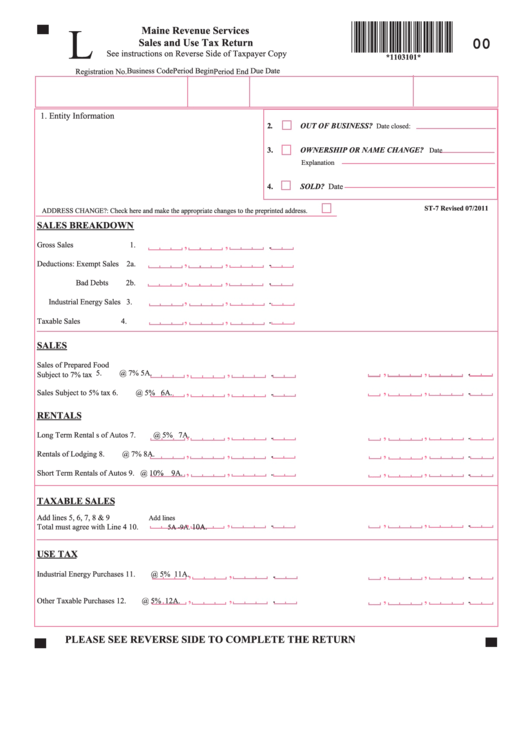

Form St-7 - Maine Revenue Services Sales And Use Tax Return

ADVERTISEMENT

L

Maine Revenue Services

00

Sales and Use Tax Return

See instructions on Reverse Side of Taxpayer Copy

*1103101*

Business Code

Period Begin

Due Date

Registration No.

Period End

1. Entity Information

OUT OF BUSINESS?

2.

Date closed:

3.

OWNERSHIP OR NAME CHANGE?

Date

Explanation

4.

SOLD? Date

ST-7 Revised 07/2011

ADDRESS CHANGE?: Check here and make the appropriate changes to the preprinted address.

SALES BREAKDOWN

,

,

.

Gross Sales

1.

,

,

.

Deductions: Exempt Sales

2a.

,

,

.

Bad Debts

2b.

,

,

.

Industrial Energy Sales

3.

,

,

.

Taxable Sales

4.

SALES

Sales of Prepared Food

,

,

.

,

,

.

5.

@ 7% 5A.

Subject to 7% tax

,

,

.

,

,

.

Sales Subject to 5% tax

6.

@ 5% 6A.

RENTALS

,

,

.

,

,

.

Long Term Rental s of Autos 7.

@ 5% 7A.

,

,

,

,

.

.

Rentals of Lodging

8.

@ 7% 8A.

,

,

.

,

,

.

Short Term Rentals of Autos 9.

@ 10% 9A.

TAXABLE SALES

Add lines 5, 6, 7, 8 & 9

Add lines

,

,

,

,

.

.

Total must agree with Line 4 10.

10A.

5A -9A.

USE TAX

,

,

.

,

,

.

Industrial Energy Purchases 11.

@ 5% 11A.

,

,

.

,

,

.

Other Taxable Purchases

12.

@ 5% 12A.

PLEASE SEE REVERSE SIDE TO COMPLETE THE RETURN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3