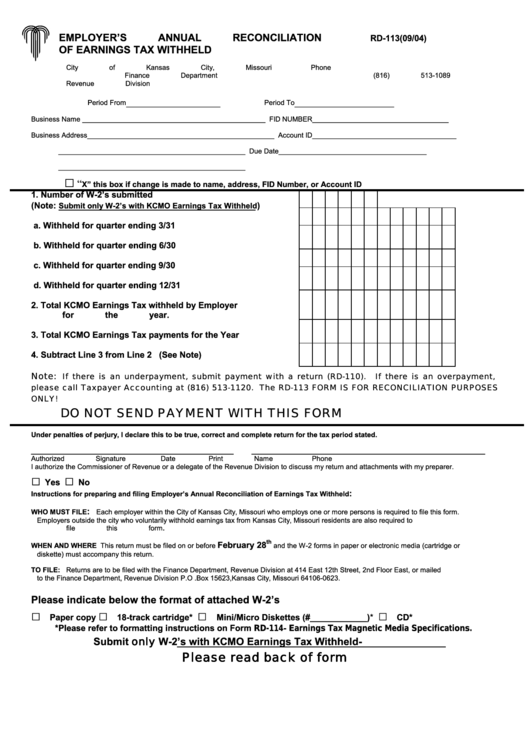

Form Rd-113 - Employer'S Annual Reconciliation Of Earnings Tax Withheld - City Of Kansas City, Missouri

ADVERTISEMENT

EMPLOYER’S ANNUAL RECONCILIATION

RD-113(09/04)

OF EARNINGS TAX WITHHELD

City of Kansas City, Missouri

Phone

Finance Department

(816) 513-1089

Revenue Division

__________________

___________________

Period From

Period To

Business Name

_______________________________________________

FID NUMBER___________________________________

Business Address________________________________________________

Account ID_____________________________________

________________________________________________

Due Date______________________________________

________________________________________________

□

“

X” this box if change is made to name, address, FID Number, or Account ID

1.

Number of W-2’s submitted

(Note:

)

Submit only W-2’s with KCMO Earnings Tax Withheld

a.

Withheld for quarter ending 3/31

b.

Withheld for quarter ending 6/30

c.

Withheld for quarter ending 9/30

d.

Withheld for quarter ending 12/31

2.

Total KCMO Earnings Tax withheld by Employer

for the year.

3.

Total KCMO Earnings Tax payments for the Year

4.

Subtract Line 3 from Line 2 (See Note)

Note:

If there is an underpayment, submit payment with a return (RD-110).

If there is an overpayment,

please call Taxpayer Accounting at (816) 513-1120. The RD-113 FORM IS FOR RECONCILIATION PURPOSES

ONLY!

DO NOT SEND PAYMENT WITH THIS FORM

Under penalties of perjury, I declare this to be true, correct and complete return for the tax period stated.

____________________________________________________

____________________________________________________________

Authorized Signature

Date

Print Name

Phone

I authorize the Commissioner of Revenue or a delegate of the Revenue Division to discuss my return and attachments with my preparer.

□

□

Yes

No

:

Instructions for preparing and filing Employer’s Annual Reconciliation of Earnings Tax Withheld

:

WHO MUST FILE

Each employer within the City of Kansas City, Missouri who employs one or more persons is required to file this form.

Employers outside the city who voluntarily withhold earnings tax from Kansas City, Missouri residents are also required to

file this form.

th

February 28

WHEN AND WHERE

This return must be filed on or before

and the W-2 forms in paper or electronic media (cartridge or

diskette) must accompany this return.

TO FILE:

Returns are to be filed with the Finance Department, Revenue Division at 414 East 12th Street, 2nd Floor East, or mailed

to the Finance Department, Revenue Division P.O .Box 15623,Kansas City, Missouri 64106-0623.

Please indicate below the format of attached W-2’s

□

□

□

□

Paper copy

18-track cartridge*

Mini/Micro Diskettes (#____________)*

CD*

*Please refer to formatting instructions on Form RD-114- Earnings Tax Magnetic Media Specifications.

Submit only W-2’s with KCMO Earnings Tax Withheld-

Please read back of form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1