Save

Reset

Print

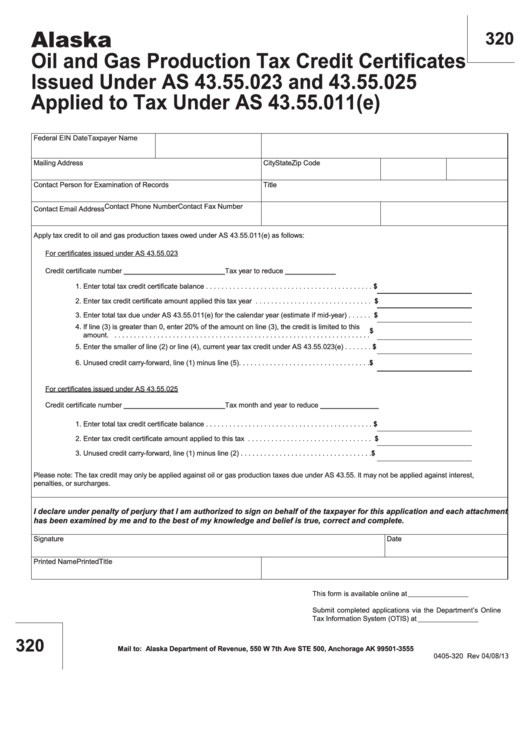

Alaska

320

Oil and Gas Production Tax Credit Certificates

Issued Under AS 43.55.023 and 43.55.025

Applied to Tax Under AS 43.55.011(e)

Federal EIN

Date

Taxpayer Name

Mailing Address

City

State

Zip Code

Contact Person for Examination of Records

Title

Contact Phone Number

Contact Fax Number

Contact Email Address

Apply tax credit to oil and gas production taxes owed under AS 43.55.011(e) as follows:

For certificates issued under AS 43.55.023

Credit certificate number __________________________

Tax year to reduce _____________

1. Enter total tax credit certificate balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. Enter tax credit certificate amount applied this tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3. Enter total tax due under AS 43.55.011(e) for the calendar year (estimate if mid-year) . . . . . . $

4. If line (3) is greater than 0, enter 20% of the amount on line (3), the credit is limited to this

$

amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Enter the smaller of line (2) or line (4), current year tax credit under AS 43.55.023(e) . . . . . . . $

6. Unused credit carry-forward, line (1) minus line (5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

For certificates issued under AS 43.55.025

Credit certificate number __________________________

Tax month and year to reduce _______________

1. Enter total tax credit certificate balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. Enter tax credit certificate amount applied to this tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3. Unused credit carry-forward, line (1) minus line (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Please note: The tax credit may only be applied against oil or gas production taxes due under AS 43.55. It may not be applied against interest,

penalties, or surcharges.

I declare under penalty of perjury that I am authorized to sign on behalf of the taxpayer for this application and each attachment

has been examined by me and to the best of my knowledge and belief is true, correct and complete.

Signature

Date

Printed Name

PrintedTitle

This form is available online at

Submit completed applications via the Department’s Online

Tax Information System (OTIS) at

320

Mail to: Alaska Department of Revenue, 550 W 7th Ave STE 500, Anchorage AK 99501-3555

0405-320 Rev

/1

1

1