Form Dr 0251 - Rta Consumer Use Tax Return And Instructions

ADVERTISEMENT

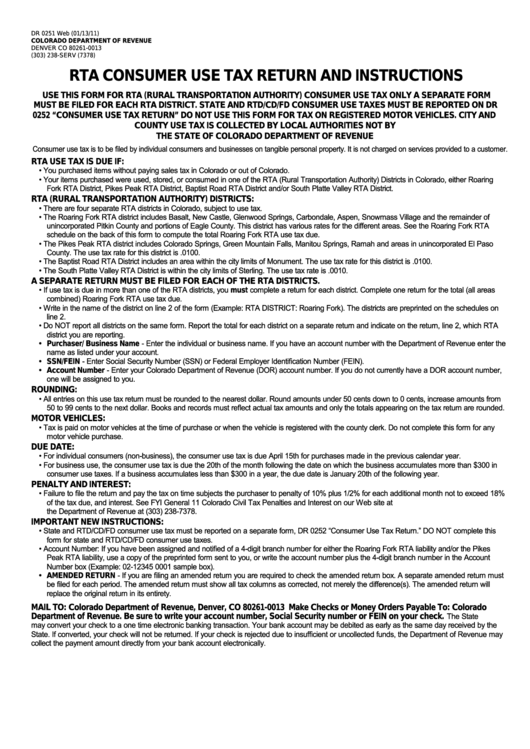

DR 0251 Web (01/13/11)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0013

(303) 238-SERV (7378)

RTA CONSUMER USE TAX RETURN AND INSTRUCTIONS

USE THIS FORM FOR RTA (RURAL TRANSPORTATION AUTHORITY) CONSUMER USE TAX ONLY A SEPARATE FORM

MUST BE FILED FOR EACH RTA DISTRICT. STATE AND RTD/CD/FD CONSUMER USE TAXES MUST BE REPORTED ON DR

0252 “CONSUMER USE TAX RETURN” DO NOT USE THIS FORM FOR TAX ON REGISTERED MOTOR VEHICLES. CITY AND

COUNTY USE TAX IS COLLECTED BY LOCAL AUTHORITIES NOT BY

THE STATE OF COLORADO DEPARTMENT OF REVENUE

Consumer use tax is to be filed by individual consumers and businesses on tangible personal property. It is not charged on services provided to a customer.

RTA USE TAX IS DUE IF:

• You purchased items without paying sales tax in Colorado or out of Colorado.

• Your items purchased were used, stored, or consumed in one of the RTA (Rural Transportation Authority) Districts in Colorado, either Roaring

Fork RTA District, Pikes Peak RTA District, Baptist Road RTA District and/or South Platte Valley RTA District.

RTA (RURAL TRANSPORTATION AUTHORITY) DISTRICTS:

• There are four separate RTA districts in Colorado, subject to use tax.

• The Roaring Fork RTA district includes Basalt, New Castle, Glenwood Springs, Carbondale, Aspen, Snowmass Village and the remainder of

unincorporated Pitkin County and portions of Eagle County. This district has various rates for the different areas. See the Roaring Fork RTA

schedule on the back of this form to compute the total Roaring Fork RTA use tax due.

• The Pikes Peak RTA district includes Colorado Springs, Green Mountain Falls, Manitou Springs, Ramah and areas in unincorporated El Paso

County. The use tax rate for this district is .0100.

• The Baptist Road RTA District includes an area within the city limits of Monument. The use tax rate for this district is .0100.

• The South Platte Valley RTA District is within the city limits of Sterling. The use tax rate is .0010.

A SEPARATE RETURN MUST BE FILED FOR EACH OF THE RTA DISTRICTS.

• If use tax is due in more than one of the RTA districts, you must complete a return for each district. Complete one return for the total (all areas

combined) Roaring Fork RTA use tax due.

• Write in the name of the district on line 2 of the form (Example: RTA DISTRICT: Roaring Fork). The districts are preprinted on the schedules on

line 2.

• Do NOT report all districts on the same form. Report the total for each district on a separate return and indicate on the return, line 2, which RTA

district you are reporting.

• Purchaser/ Business Name - Enter the individual or business name. If you have an account number with the Department of Revenue enter the

name as listed under your account.

• SSN/FEIN - Enter Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

• Account Number - Enter your Colorado Department of Revenue (DOR) account number. If you do not currently have a DOR account number,

one will be assigned to you.

ROUNDING:

• All entries on this use tax return must be rounded to the nearest dollar. Round amounts under 50 cents down to 0 cents, increase amounts from

50 to 99 cents to the next dollar. Books and records must reflect actual tax amounts and only the totals appearing on the tax return are rounded.

MOTOR VEHICLES:

• Tax is paid on motor vehicles at the time of purchase or when the vehicle is registered with the county clerk. Do not complete this form for any

motor vehicle purchase.

DUE DATE:

• For individual consumers (non-business), the consumer use tax is due April 15th for purchases made in the previous calendar year.

• For business use, the consumer use tax is due the 20th of the month following the date on which the business accumulates more than $300 in

consumer use taxes. If a business accumulates less than $300 in a year, the due date is January 20th of the following year.

PENALTY AND INTEREST:

• Failure to file the return and pay the tax on time subjects the purchaser to penalty of 10% plus 1/2% for each additional month not to exceed 18%

of the tax due, and interest. See FYI General 11 Colorado Civil Tax Penalties and Interest on our Web site at or contact

the Department of Revenue at (303) 238-7378.

IMPORTANT NEW INSTRUCTIONS:

• State and RTD/CD/FD consumer use tax must be reported on a separate form, DR 0252 “Consumer Use Tax Return.” DO NOT complete this

form for state and RTD/CD/FD consumer use taxes.

• Account Number: If you have been assigned and notified of a 4-digit branch number for either the Roaring Fork RTA liability and/or the Pikes

Peak RTA liability, use a copy of the preprinted form sent to you, or write the account number plus the 4-digit branch number in the Account

Number box (Example: 02-12345 0001 sample box).

• AMENDED RETURN - If you are filing an amended return you are required to check the amended return box. A separate amended return must

be filed for each period. The amended return must show all tax columns as corrected, not merely the difference(s). The amended return will

replace the original return in its entirety.

MAIL TO: Colorado Department of Revenue, Denver, CO 80261-0013 Make Checks or Money Orders Payable To: Colorado

The State

Department of Revenue. Be sure to write your account number, Social Security number or FEIN on your check.

may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the

State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may

collect the payment amount directly from your bank account electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4