4

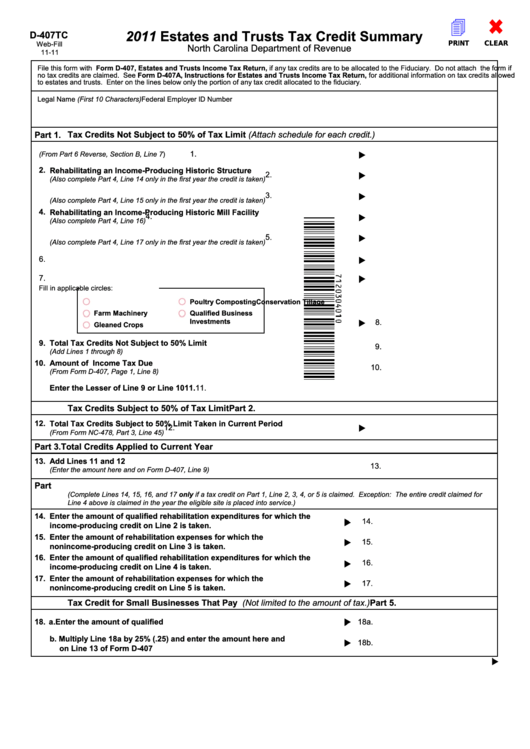

2011 Estates and Trusts Tax Credit Summary

D-407TC

Web-Fill

PRINT

CLEAR

North Carolina Department of Revenue

11-11

File this form with Form D-407, Estates and Trusts Income Tax Return, if any tax credits are to be allocated to the Fiduciary. Do not attach the form if

no tax credits are claimed. See Form D-407A, Instructions for Estates and Trusts Income Tax Return, for additional information on tax credits allowed

to estates and trusts. Enter on the lines below only the portion of any tax credit allocated to the fiduciary.

Legal Name (First 10 Characters)

Federal Employer ID Number

Tax Credits Not Subject to 50% of Tax Limit (Attach schedule for each credit.)

Part 1.

1. Credit for Tax Paid to Another State or Country

1.

(From Part 6 Reverse, Section B, Line 7)

2. Rehabilitating an Income-Producing Historic Structure

2.

(Also complete Part 4, Line 14 only in the first year the credit is taken)

3. Rehabilitating a Nonincome-Producing Historic Structure

3.

(Also complete Part 4, Line 15 only in the first year the credit is taken)

4. Rehabilitating an Income-Producing Historic Mill Facility

4.

(Also complete Part 4, Line 16)

5. Rehabilitating a Nonincome-Producing Historic Mill Facility

5.

(Also complete Part 4, Line 17 only in the first year the credit is taken)

6. Certain Real Property Donations

6.

7. Handicapped Dwelling Units

7.

8. Other

Fill in applicable circles:

Conservation Tillage

Poultry Composting

Farm Machinery

Qualified Business

Investments

8.

Gleaned Crops

9.

Total Tax Credits Not Subject to 50% Limit

9.

(Add Lines 1 through 8)

10.

Amount of Income Tax Due

10.

(From Form D-407, Page 1, Line 8)

11.

Enter the Lesser of Line 9 or Line 10

11.

Part 2.

Tax Credits Subject to 50% of Tax Limit

12. Total Tax Credits Subject to 50% Limit Taken in Current Period

12.

(From Form NC-478, Part 3, Line 45)

Part 3. Total Credits Applied to Current Year

13.

Add Lines 11 and 12

13.

(Enter the amount here and on Form D-407, Line 9)

Part 4. Expenses Incurred for Which the First Installment of a Historic Rehabilitation Tax Credit is Taken in 2011

(Complete Lines 14, 15, 16, and 17 only if a tax credit on Part 1, Line 2, 3, 4, or 5 is claimed. Exception: The entire credit claimed for

Line 4 above is claimed in the year the eligible site is placed into service.)

14.

Enter the amount of qualified rehabilitation expenditures for which the

14.

income-producing credit on Line 2 is taken.

15.

Enter the amount of rehabilitation expenses for which the

15.

nonincome-producing credit on Line 3 is taken.

16.

Enter the amount of qualified rehabilitation expenditures for which the

16.

income-producing credit on Line 4 is taken.

17.

Enter the amount of rehabilitation expenses for which the

17.

nonincome-producing credit on Line 5 is taken.

Part 5.

Tax Credit for Small Businesses That Pay N.C. Unemployment Insurance (Not limited to the amount of tax.)

18a.

18. a. Enter the amount of qualified N.C. Unemployment Insurance Contributions

b. Multiply Line 18a by 25% (.25) and enter the amount here and

18b.

on Line 13 of Form D-407

1

1 2

2