D-41ES Estimated Payment for Fiduciary Income Tax

Instructions:

• Use the D-41ES Estimated Payment Return to make any estimated tax payments for your D-41 return.

• Enter your payment amount.

• Enter your estate or trust FEIN or SSN.

• Enter name(s) and address exactly as they are on your return.

• Make your check or money order payable to the DC Treasurer.

• Write the estate or trust FEIN/SSN, tax period and D-41 on your payment (check or money order).

• Mail the D-41ES with payment to the Office of Tax and Revenue, PO Box 441, Washington, DC 20044-0441.

Notes:

• If your liability exceeds $10,000 in any period, you must pay electronically.

Visit

• For electronic filers, in order to comply with the new banking rules, you will be asked the question, “Will the funds for this payment

come from an account outside of the United States”. If the answer is yes, you will be required to pay by check or credit card. Please

notify this agency if your response changes in the future. If your payment is rejected, you may be subject to the District’s dishonored

check fee and additional penalties and interest.

Send the D-41ES to: Office of Tax and Revenue, PO Box 441, Washington, DC 20044-0441

Print

Clear

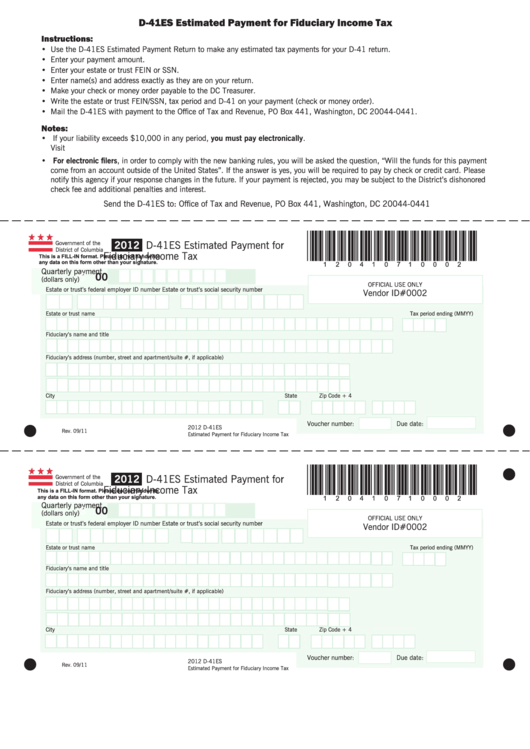

*120410710002*

2012

D-41ES Estimated Payment for

Government of the

District of Columbia

Fiduciary Income Tax

This is a FILL-IN format. Please do not handwrite

any data on this form other than your signature.

Quarterly payment

.00

$

(dollars only)

OFFICIAL USE ONLY

Estate or trust’s federal employer ID number

Estate or trust’s social security number

Vendor ID#0002

Estate or trust name

Tax period ending (MMYY)

Fiduciary’s name and title

Fiduciary’s address (number, street and apartment/suite #, if applicable)

City

State

Zip Code + 4

l

l

Voucher number:

Due date:

2012 D-41ES

Rev. 09/11

Estimated Payment for Fiduciary Income Tax

Print

Clear

l

*120410710002*

2012

D-41ES Estimated Payment for

Government of the

District of Columbia

Fiduciary Income Tax

This is a FILL-IN format. Please do not handwrite

any data on this form other than your signature.

Quarterly payment

$

.00

(dollars only)

OFFICIAL USE ONLY

Estate or trust’s federal employer ID number

Estate or trust’s social security number

Vendor ID#0002

Estate or trust name

Tax period ending (MMYY)

Fiduciary’s name and title

Fiduciary’s address (number, street and apartment/suite #, if applicable)

City

State

Zip Code + 4

l

Voucher number:

Due date:

l

2012 D-41ES

Rev. 09/11

Estimated Payment for Fiduciary Income Tax

1

1