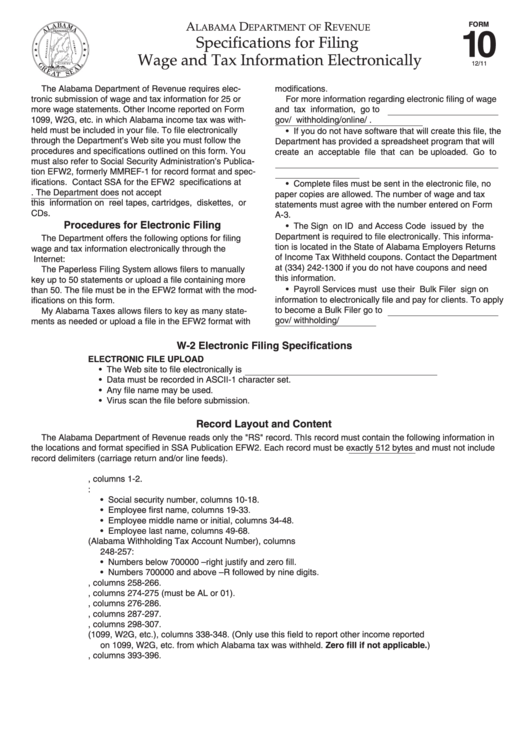

Form 10 - Specifications For Filing Wage And Tax Information Electronically

ADVERTISEMENT

A

D

R

FORM

LABAMA

EPARTMENT OF

EVENUE

10

Specifications for Filing

Wage and Tax Information Electronically

12/11

The Alabama Department of Revenue requires elec-

modifications.

tronic submission of wage and tax information for 25 or

For more information regarding electronic filing of wage

more wage statements. Other Income reported on Form

and tax information, go to

1099, W2G, etc. in which Alabama income tax was with-

gov/withholding/online/W2FileInstr.htm.

held must be included in your file. To file electronically

• If you do not have software that will create this file, the

through the Department’s Web site you must follow the

Department has provided a spreadsheet program that will

procedures and specifications outlined on this form. You

create an acceptable file that can be uploaded. Go to

must also refer to Social Security Administration’s Publica-

gov/withholding/online/

tion EFW2, formerly MMREF-1 for record format and spec-

createW2FileInstr.htm for more information.

ifications. Contact SSA for the EFW2 specifications at

• Complete files must be sent in the electronic file, no

The Department does not accept

paper copies are allowed. The number of wage and tax

this information on reel tapes, cartridges, diskettes, or

statements must agree with the number entered on Form

CDs.

A-3.

Procedures for Electronic Filing

• The Sign on ID and Access Code issued by the

Department is required to file electronically. This informa-

The Department offers the following options for filing

tion is located in the State of Alabama Employers Returns

wage and tax information electronically through the

of Income Tax Withheld coupons. Contact the Department

Internet:

at (334) 242-1300 if you do not have coupons and need

The Paperless Filing System allows filers to manually

this information.

key up to 50 statements or upload a file containing more

• Payroll Services must use their Bulk Filer sign on

than 50. The file must be in the EFW2 format with the mod-

information to electronically file and pay for clients. To apply

ifications on this form.

to become a Bulk Filer go to

My Alabama Taxes allows filers to key as many state-

gov/withholding/bulkfl.html.

ments as needed or upload a file in the EFW2 format with

W-2 Electronic Filing Specifications

ELECTRONIC FILE UPLOAD

• The Web site to file electronically is

• Data must be recorded in ASCII-1 character set.

• Any file name may be used.

• Virus scan the file before submission.

Record Layout and Content

The Alabama Department of Revenue reads only the "RS" record. ThIs record must contain the following information in

the locations and format specified in SSA Publication EFW2. Each record must be exactly 512 bytes and must not include

record delimiters (carriage return and/or line feeds).

a. Record identifier, columns 1-2.

b. Employee information:

• Social security number, columns 10-18.

• Employee first name, columns 19-33.

• Employee middle name or initial, columns 34-48.

• Employee last name, columns 49-68.

c. State Employer Account Number (Alabama Withholding Tax Account Number), columns

248-257:

• Numbers below 700000 – right justify and zero fill.

• Numbers 700000 and above – R followed by nine digits.

d. Federal Employer Identification Number, columns 258-266.

e. State code, columns 274-275 (must be AL or 01).

f. State taxable wages, columns 276-286.

g. State income tax withheld, columns 287-297.

h. Federal income tax withheld, columns 298-307.

i. Other income (1099, W2G, etc.), columns 338-348. (Only use this field to report other income reported

on 1099, W2G, etc. from which Alabama tax was withheld. Zero fill if not applicable.)

j. Payment year, columns 393-396.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1