Form 49b - Form Of Application For Allotment Of Tax Deduction And Collection Account Number Under Section 203a Of The Income Tax Act, 1961

ADVERTISEMENT

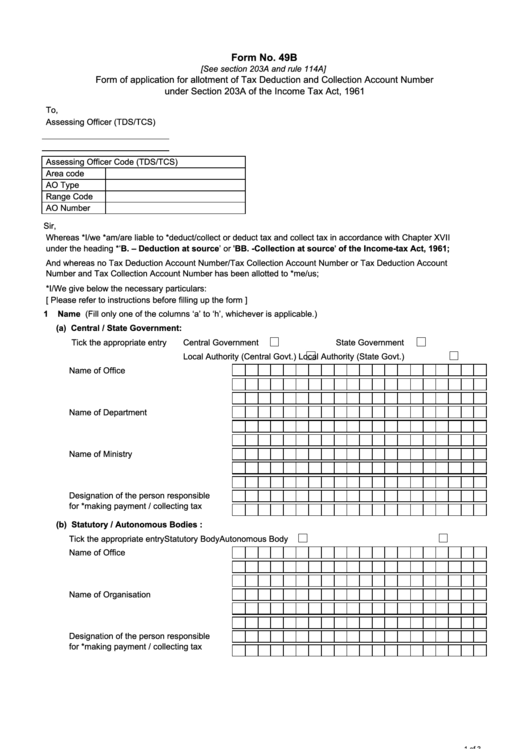

Form No. 49B

[See section 203A and rule 114A]

Form of application for allotment of Tax Deduction and Collection Account Number

under Section 203A of the Income Tax Act, 1961

To,

Assessing Officer (TDS/TCS)

Assessing Officer Code (TDS/TCS)

Area code

AO Type

Range Code

AO Number

Sir,

Whereas *I/we *am/are liable to *deduct/collect or deduct tax and collect tax in accordance with Chapter XVII

under the heading *‘B. – Deduction at source’ or 'BB. -Collection at source' of the Income-tax Act, 1961;

And whereas no Tax Deduction Account Number/Tax Collection Account Number or Tax Deduction Account

Number and Tax Collection Account Number has been allotted to *me/us;

*I/We give below the necessary particulars:

[ Please refer to instructions before filling up the form ]

1

Name

(Fill only one of the columns ‘a’ to ‘h’, whichever is applicable.)

(a) Central / State Government:

Tick the appropriate entry

Tick the appropriate entry

Central Government

Central Government

State Government

State Government

Local Authority (Central Govt.)

Local Authority (State Govt.)

Name of Office

Name of Department

Name of Ministry

Designation of the person responsible

for *making payment / collecting tax

(b) Statutory / Autonomous Bodies :

Tick the appropriate entry

Statutory Body

Autonomous Body

Name of Office

Name of Organisation

Designation of the person responsible

for *making payment / collecting tax

1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3

![Form 49aa - Application For Allotment Of Permanent Account Number [individuals Not Being A Citizen Of India/entities Incorporated Outside India/ Unincorporated Entities Formed Outside India] Form 49aa - Application For Allotment Of Permanent Account Number [individuals Not Being A Citizen Of India/entities Incorporated Outside India/ Unincorporated Entities Formed Outside India]](https://data.formsbank.com/pdf_docs_html/379/3799/379953/page_1_thumb.png)