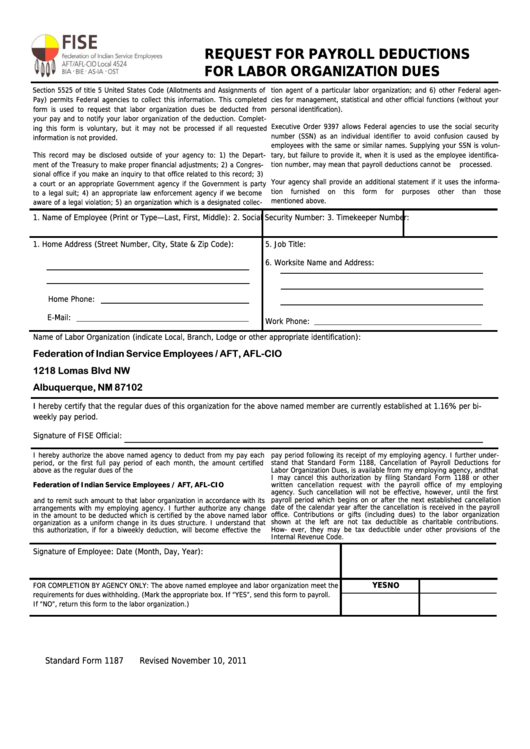

Standard Form 1187 - Request For Payroll Deductions For Labor Organization Dues - Federation Of Indian Service Employees

ADVERTISEMENT

REQUEST FOR PAYROLL DEDUCTIONS

FOR LABOR ORGANIZATION DUES

Section 5525 of title 5 United States Code (Allotments and Assignments of

tion agent of a particular labor organization; and 6) other Federal agen-

Pay) permits Federal agencies to collect this information. This completed

cies for management, statistical and other official functions (without your

form is used to request that labor organization dues be deducted from

personal identification).

your pay and to notify your labor organization of the deduction. Complet-

Executive Order 9397 allows Federal agencies to use the social security

ing this form is voluntary, but it may not be processed if all requested

number (SSN) as an individual identifier to avoid confusion caused by

information is not provided.

employees with the same or similar names. Supplying your SSN is volun-

This record may be disclosed outside of your agency to: 1) the Depart-

tary, but failure to provide it, when it is used as the employee identifica-

ment of the Treasury to make proper financial adjustments; 2) a Congres-

tion number, may mean that payroll deductions cannot be

processed.

sional office if you make an inquiry to that office related to this record; 3)

Your agency shall provide an additional statement if it uses the informa-

a court or an appropriate Government agency if the Government is party

tion

furnished

on

this

form

for

purposes

other

than

those

to a legal suit; 4) an appropriate law enforcement agency if we become

mentioned above.

aware of a legal violation; 5) an organization which is a designated collec-

1. Name of Employee (Print or Type—Last, First, Middle):

2. Social Security Number:

3. Timekeeper Number:

1.

Home Address (Street Number, City, State & Zip Code):

5. Job Title:

6. Worksite Name and Address:

Home Phone:

E-Mail:

Work Phone:

Name of Labor Organization (indicate Local, Branch, Lodge or other appropriate identification):

Federation of Indian Service Employees / AFT, AFL-CIO

1218 Lomas Blvd NW

Albuquerque, NM 87102

I hereby certify that the regular dues of this organization for the above named member are currently established at 1.16% per bi-

weekly pay period.

Signature of FISE Official:

I hereby authorize the above named agency to deduct from my pay each

pay period following its receipt of my employing agency. I further under-

period, or the first full pay period of each month, the amount certified

stand that Standard Form 1188, Cancellation of Payroll Deductions for

above as the regular dues of the

Labor Organization Dues, is available from my employing agency, and that

I may cancel this authorization by filing Standard Form 1188 or other

written cancellation request with the payroll office of my employing

Federation of Indian Service Employees / AFT, AFL-CIO

agency. Such cancellation will not be effective, however, until the first

payroll period which begins on or after the next established cancellation

and to remit such amount to that labor organization in accordance with its

date of the calendar year after the cancellation is received in the payroll

arrangements with my employing agency. I further authorize any change

office. Contributions or gifts (including dues) to the labor organization

in the amount to be deducted which is certified by the above named labor

shown at the left are not tax deductible as charitable contributions.

organization as a uniform change in its dues structure. I understand that

How- ever, they may be tax deductible under other provisions of the

this authorization, if for a biweekly deduction, will become effective the

Internal Revenue Code.

Signature of Employee:

Date (Month, Day, Year):

FOR COMPLETION BY AGENCY ONLY: The above named employee and labor organization meet the

YES

NO

requirements for dues withholding. (Mark the appropriate box. If “YES”, send this form to payroll.

If “NO”, return this form to the labor organization.)

Standard Form 1187

Revised November 10, 2011

U.S. Office of Personnel Management

FPM Chapter 550

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1