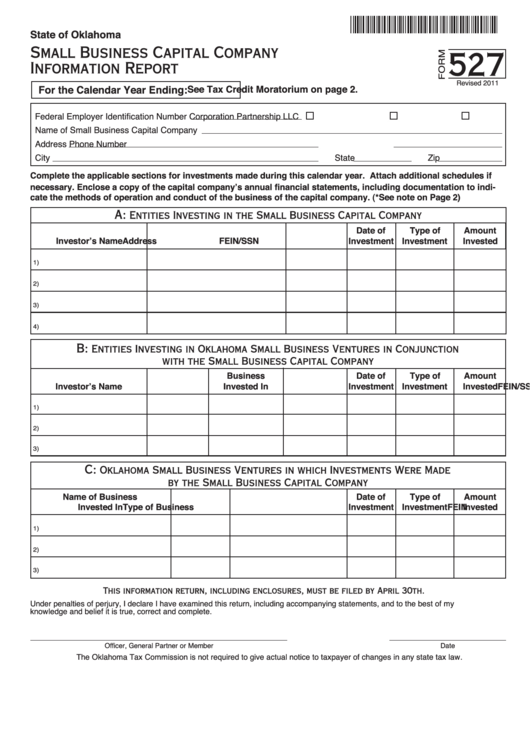

State of Oklahoma

Small Business Capital Company

527

Information Report

Revised 2011

For the Calendar Year Ending:

See Tax Credit Moratorium on page 2.

Federal Employer Identification Number

Corporation

Partnership

LLC

Name of Small Business Capital Company

Address

Phone Number

City

State

Zip

Complete the applicable sections for investments made during this calendar year. Attach additional schedules if

necessary. Enclose a copy of the capital company’s annual financial statements, including documentation to indi-

cate the methods of operation and conduct of the business of the capital company. (*See note on Page 2)

A:

Entities Investing in the Small Business Capital Company

Date of

Type of

Amount

Investor’s Name

Address

FEIN/SSN

Investment

Investment

Invested

1)

2)

3)

4)

B:

Entities Investing in Oklahoma Small Business Ventures in Conjunction

with the Small Business Capital Company

Business

Date of

Type of

Amount

Investor’s Name

FEIN/SSN

Invested In

FEIN

Investment

Investment

Invested

1)

2)

3)

C:

Oklahoma Small Business Ventures in which Investments Were Made

by the Small Business Capital Company

Name of Business

Date of

Type of

Amount

Invested In

FEIN

Type of Business

Investment

Investment

Invested

1)

2)

3)

This information return, including enclosures, must be filed by April 30th.

Under penalties of perjury, I declare I have examined this return, including accompanying statements, and to the best of my

knowledge and belief it is true, correct and complete.

Officer, General Partner or Member

Date

The Oklahoma Tax Commission is not required to give actual notice to taxpayer of changes in any state tax law.

1

1 2

2 3

3