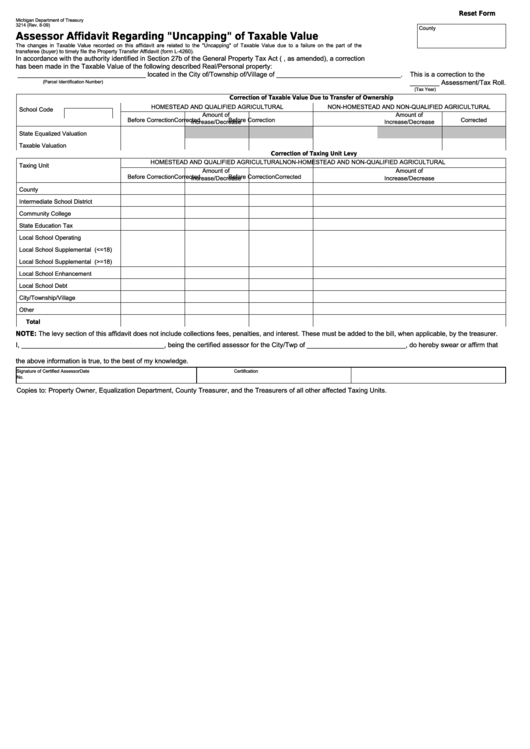

Reset Form

Michigan Department of Treasury

3214 (Rev. 8-09)

County

Assessor Affidavit Regarding "Uncapping" of Taxable Value

The changes in Taxable Value recorded on this affidavit are related to the "Uncapping" of Taxable Value due to a failure on the part of the

transferee (buyer) to timely file the Property Transfer Affidavit (form L-4260).

In accordance with the authority identified in Section 27b of the General Property Tax Act (P.A. 206 of 1893, as amended), a correction

has been made in the Taxable Value of the following described Real/Personal property:

___________________________________ located in the City of/Township of/Village of __________________________________.

This is a correction to the

________ Assessment/Tax Roll.

(Parcel Identification Number)

(Tax Year)

Correction of Taxable Value Due to Transfer of Ownership

HOMESTEAD AND QUALIFIED AGRICULTURAL

NON-HOMESTEAD AND NON-QUALIFIED AGRICULTURAL

School Code

Amount of

Amount of

Before Correction

Corrected

Before Correction

Corrected

Increase/Decrease

Increase/Decrease

State Equalized Valuation

Taxable Valuation

Correction of Taxing Unit Levy

HOMESTEAD AND QUALIFIED AGRICULTURAL

NON-HOMESTEAD AND NON-QUALIFIED AGRICULTURAL

Taxing Unit

Amount of

Amount of

Before Correction

Corrected

Before Correction

Corrected

Increase/Decrease

Increase/Decrease

County

Intermediate School District

Community College

State Education Tax

Local School Operating

Local School Supplemental (<=18)

Local School Supplemental (>=18)

Local School Enhancement

Local School Debt

City/Township/Village

Other

Total

NOTE: The levy section of this affidavit does not include collections fees, penalties, and interest. These must be added to the bill, when applicable, by the treasurer.

I, _______________________________________, being the certified assessor for the City/Twp of ___________________________, do hereby swear or affirm that

the above information is true, to the best of my knowledge.

Signature of Certified Assessor

Date

Certification

No.

Copies to: Property Owner, Equalization Department, County Treasurer, and the Treasurers of all other affected Taxing Units.

1

1