Instructions For Form Ft-1120 - Electric Companies And Combined Electric Companies Tax - Ohio Corporation Franchise Tax - 2005

ADVERTISEMENT

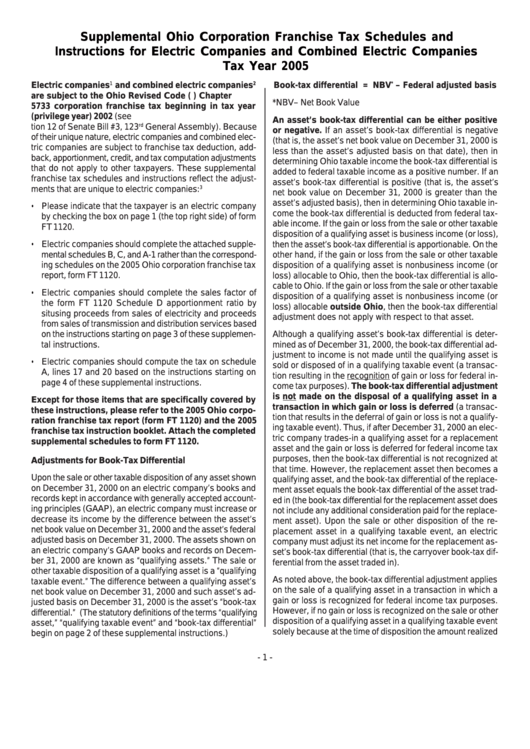

Supplemental Ohio Corporation Franchise Tax Schedules and

Instructions for Electric Companies and Combined Electric Companies

Tax Year 2005

1

2

*

Electric companies

and combined electric companies

Book-tax differential = NBV

– Federal adjusted basis

are subject to the Ohio Revised Code (O.R.C.) Chapter

*NBV– Net Book Value

5733 corporation franchise tax beginning in tax year

(privilege year) 2002 (see O.R.C. section 5733.09 and sec-

An asset’s book-tax differential can be either positive

rd

tion 12 of Senate Bill #3, 123

General Assembly). Because

or negative. If an asset’s book-tax differential is negative

of their unique nature, electric companies and combined elec-

(that is, the asset’s net book value on December 31, 2000 is

tric companies are subject to franchise tax deduction, add-

less than the asset’s adjusted basis on that date), then in

back, apportionment, credit, and tax computation adjustments

determining Ohio taxable income the book-tax differential is

that do not apply to other taxpayers. These supplemental

added to federal taxable income as a positive number. If an

franchise tax schedules and instructions reflect the adjust-

asset’s book-tax differential is positive (that is, the asset’s

3

ments that are unique to electric companies:

net book value on December 31, 2000 is greater than the

asset’s adjusted basis), then in determining Ohio taxable in-

Please indicate that the taxpayer is an electric company

•

come the book-tax differential is deducted from federal tax-

by checking the box on page 1 (the top right side) of form

able income. If the gain or loss from the sale or other taxable

FT 1120.

disposition of a qualifying asset is business income (or loss),

Electric companies should complete the attached supple-

•

then the asset’s book-tax differential is apportionable. On the

mental schedules B, C, and A-1 rather than the correspond-

other hand, if the gain or loss from the sale or other taxable

ing schedules on the 2005 Ohio corporation franchise tax

disposition of a qualifying asset is nonbusiness income (or

report, form FT 1120.

loss) allocable to Ohio, then the book-tax differential is allo-

cable to Ohio. If the gain or loss from the sale or other taxable

Electric companies should complete the sales factor of

•

disposition of a qualifying asset is nonbusiness income (or

the form FT 1120 Schedule D apportionment ratio by

loss) allocable outside Ohio, then the book-tax differential

situsing proceeds from sales of electricity and proceeds

adjustment does not apply with respect to that asset.

from sales of transmission and distribution services based

on the instructions starting on page 3 of these supplemen-

Although a qualifying asset’s book-tax differential is deter-

tal instructions.

mined as of December 31, 2000, the book-tax differential ad-

justment to income is not made until the qualifying asset is

Electric companies should compute the tax on schedule

•

sold or disposed of in a qualifying taxable event (a transac-

A, lines 17 and 20 based on the instructions starting on

tion resulting in the recognition of gain or loss for federal in-

page 4 of these supplemental instructions.

come tax purposes). The book-tax differential adjustment

is not made on the disposal of a qualifying asset in a

Except for those items that are specifically covered by

transaction in which gain or loss is deferred (a transac-

these instructions, please refer to the 2005 Ohio corpo-

tion that results in the deferral of gain or loss is not a qualify-

ration franchise tax report (form FT 1120) and the 2005

ing taxable event). Thus, if after December 31, 2000 an elec-

franchise tax instruction booklet. Attach the completed

tric company trades-in a qualifying asset for a replacement

supplemental schedules to form FT 1120.

asset and the gain or loss is deferred for federal income tax

purposes, then the book-tax differential is not recognized at

Adjustments for Book-Tax Differential

that time. However, the replacement asset then becomes a

Upon the sale or other taxable disposition of any asset shown

qualifying asset, and the book-tax differential of the replace-

on December 31, 2000 on an electric company’s books and

ment asset equals the book-tax differential of the asset trad-

records kept in accordance with generally accepted account-

ed in (the book-tax differential for the replacement asset does

ing principles (GAAP), an electric company must increase or

not include any additional consideration paid for the replace-

decrease its income by the difference between the asset’s

ment asset). Upon the sale or other disposition of the re-

net book value on December 31, 2000 and the asset’s federal

placement asset in a qualifying taxable event, an electric

adjusted basis on December 31, 2000. The assets shown on

company must adjust its net income for the replacement as-

an electric company’s GAAP books and records on Decem-

set’s book-tax differential (that is, the carryover book-tax dif-

ber 31, 2000 are known as “qualifying assets.” The sale or

ferential from the asset traded in).

other taxable disposition of a qualifying asset is a “qualifying

As noted above, the book-tax differential adjustment applies

taxable event.” The difference between a qualifying asset’s

on the sale of a qualifying asset in a transaction in which a

net book value on December 31, 2000 and such asset’s ad-

gain or loss is recognized for federal income tax purposes.

justed basis on December 31, 2000 is the asset’s “book-tax

However, if no gain or loss is recognized on the sale or other

differential.” (The statutory definitions of the terms “qualifying

disposition of a qualifying asset in a qualifying taxable event

asset,” “qualifying taxable event” and “book-tax differential”

solely because at the time of disposition the amount realized

begin on page 2 of these supplemental instructions.)

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5