Instructions For Form St-500 5182 - Moving To South Carolina A Tax Guide For New Residents Page 3

ADVERTISEMENT

Residential Property

The market value of a legal residence and up to five acres of surrounding land is assessed at 4% of fair market value.

This market value is determined as a result of a periodic countywide reassessment. The millage rate of the local

government is then applied to the assessed value resulting in the tax liability. The millage rate is set by local governments

and varies widely throughout the state.

The fair market value of owner-occupied residential property receiving the 4% assessment rate is exempt from all

property taxes imposed for school operating purposes.

Based on a $100,000 owner-occupied residence assessed at 4% with a millage rate of 200 mills, the property taxes would

be $800. Millage rates vary from county to county and you would need to check with officials in the county you wish to

reside to estimate your property tax liability.

If you have resided in South Carolina for a full calendar year and you are 65 or older, legally blind or permanently and

totally disabled, you are eligible for a homestead exemption of $50,000 from the value of your home. Based on the

example given earlier, the same $100,000 owner-occupied residence receiving a homestead exemption and assessed at

4% with a millage rate of 200 mills would have a property tax liability of $400. The assessment ratio on a second home or

vacation home owned by you is 6%. The exemption for school operating purposes does not apply to a second home.

For more information about the tax on real estate, call the assessor in the county where you live or plan to relocate.

Vehicle Property Taxes

Personal property taxes are collected annually on cars, motorcycles, recreational vehicles, boats and airplanes based on

values listed in the Department of Revenue publications supplied to counties. The value of your vehicle is multiplied by

the assessment ratio to determine the assessed value. The applicable millage rate is multiplied by the assessed value of

your vehicle to determine the amount of personal property tax that you owe. If you own a car valued at $10,000, based on

the average statewide millage rate, your personal property tax would be about $173 annually.

For information about personal property tax, call the auditor’s office in the county where you live or plan to relocate.

Sales and Use Tax

South Carolina’s general state sales and use tax rate is currently 6%. In certain counties, local sales and use taxes are

imposed in addition to the 6% state rate. The general local sales and use tax collected on the behalf of local jurisdictions

is for school projects, road improvements, capital projects and other purposes.

Prescription medicines, dental prosthetics and electricity, natural gas and fuel oil used for residential purposes are exempt

from the state and local sales and use tax. South Carolina residents age 85 or older are exempt from 1% of the state

sales tax rate. A maximum sales tax of $300 is imposed on the purchase of motor vehicles, motorcycles, boats,

recreational vehicles and airplanes.

Use Tax

The Department of Revenue strongly enforces the use tax on purchases made out-of-state when an equal amount of

sales or use tax was not due and paid in the other state at the time at the time of purchase. If you purchase goods from

the internet, catalogs, television shopping networks or other out-of-state businesses and did not pay sales tax, you must

report and pay the a 6% state rate and any applicable local use tax rate due in South Carolina. The use tax can be

conveniently reported on South Carolina’s individual income tax return. You may also download the Use Tax Form, UT-3

from the Department of Revenue’s website,

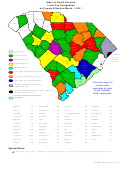

The tax rate information on the attached chart, ST-500 (located on page 6), lists the current tax rate at the time of

publication. This chart is revised periodically to reflect changes in the sales tax rate. Counties can impose a new tax rate

at any time, which would impact the tax rates shown. A complete updated list of all counties with local taxes can be found

on our website under Sales and Use > Publications.

52293016

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6