Form Dr-95b - Schedule Of Florida Sales Or Use Tax Credits Claimed On Repossessed Motor Vehicles

ADVERTISEMENT

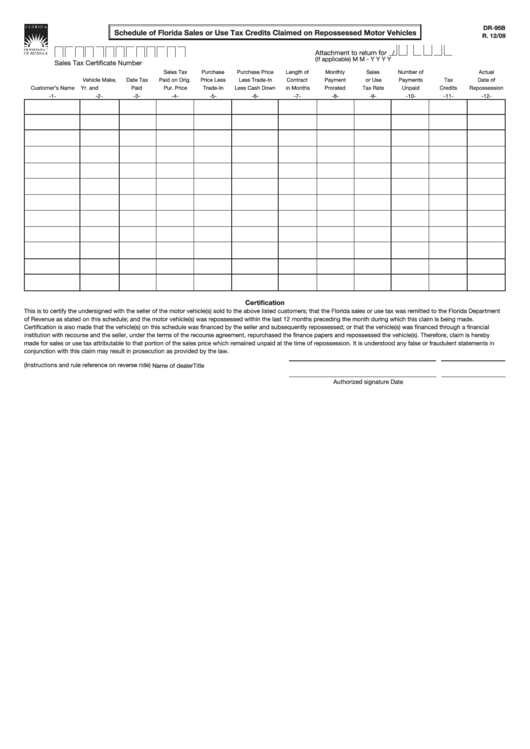

DR-95B

Schedule of Florida Sales or Use Tax Credits Claimed on Repossessed Motor Vehicles

R. 12/09

Attachment to return for

/

(If applicable)

M M - Y Y Y Y

Sales Tax Certificate Number

Sales Tax

Purchase

Purchase Price

Length of

Monthly

Sales

Number of

Actual

Vehicle Make,

Date Tax

Paid on Orig.

Price Less

Less Trade-In

Contract

Payment

or Use

Payments

Tax

Date of

Customer’s Name

Yr. and I.D. No.

Paid

Pur. Price

Trade-In

Less Cash Down

in Months

Prorated

Tax Rate

Unpaid

Credits

Repossession

-1-

-2-

-3-

-4-

-5-

-6-

-7-

-8-

-9-

-10-

-11-

-12-

Certification

This is to certify the undersigned with the seller of the motor vehicle(s) sold to the above listed customers; that the Florida sales or use tax was remitted to the Florida Department

of Revenue as stated on this schedule; and the motor vehicle(s) was repossessed within the last 12 months preceding the month during which this claim is being made.

Certification is also made that the vehicle(s) on this schedule was financed by the seller and subsequently repossessed; or that the vehicle(s) was financed through a financial

institution with recourse and the seller, under the terms of the recourse agreement, repurchased the finance papers and repossessed the vehicle(s). Therefore, claim is hereby

made for sales or use tax attributable to that portion of the sales price which remained unpaid at the time of repossession. It is understood any false or fraudulent statements in

conjunction with this claim may result in prosecution as provided by the law.

(Instructions and rule reference on reverse ride)

Name of dealer

Title

Authorized signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2