Form Dr-185 - Application For Fuel Tax Refund Permit

ADVERTISEMENT

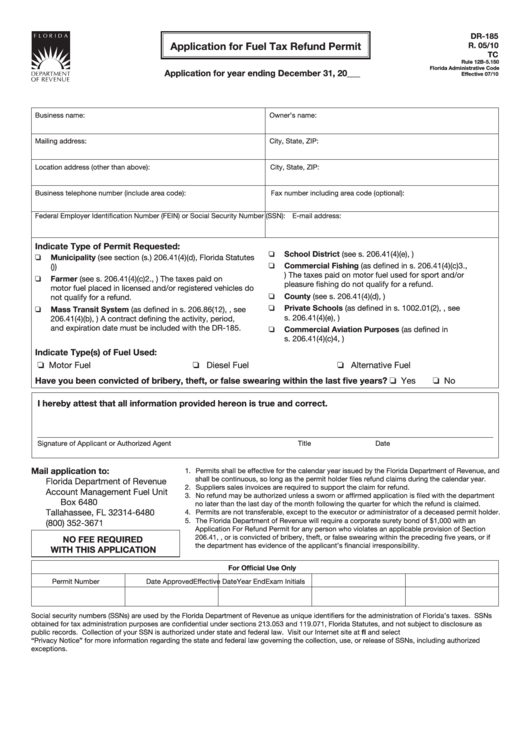

DR-185

Application for Fuel Tax Refund Permit

R. 05/10

TC

Rule 12B-5.150

Florida Administrative Code

Application for year ending December 31, 20___

Effective 07/10

Business name:

Owner’s name:

Mailing address:

City, State, ZIP:

Location address (other than above):

City, State, ZIP:

Business telephone number (include area code):

Fax number including area code (optional):

Federal Employer Identification Number (FEIN) or Social Security Number (SSN): E-mail address:

Indicate Type of Permit Requested:

School District (see s. 206.41(4)(e), F.S.)

Municipality (see section (s.) 206.41(4)(d), Florida Statutes

Commercial Fishing (as defined in s. 206.41(4)(c)3.,

(F.S.))

F.S.) The taxes paid on motor fuel used for sport and/or

Farmer (see s. 206.41(4)(c)2., F.S.) The taxes paid on

pleasure fishing do not qualify for a refund.

motor fuel placed in licensed and/or registered vehicles do

County (see s. 206.41(4)(d), F.S.)

not qualify for a refund.

Private Schools (as defined in s. 1002.01(2), F.S., see

Mass Transit System (as defined in s. 206.86(12), F.S., see

s. 206.41(4)(e), F.S.)

206.41(4)(b), F.S.) A contract defining the activity, period,

and expiration date must be included with the DR-185.

Commercial Aviation Purposes (as defined in

s. 206.41(4)(c)4, F.S.)

Indicate Type(s) of Fuel Used:

Motor Fuel

Diesel Fuel

Alternative Fuel

Have you been convicted of bribery, theft, or false swearing within the last five years?

Yes No

I hereby attest that all information provided hereon is true and correct.

Signature of Applicant or Authorized Agent

Title

Date

Mail application to:

1. Permits shall be effective for the calendar year issued by the Florida Department of Revenue, and

shall be continuous, so long as the permit holder files refund claims during the calendar year.

Florida Department of Revenue

2. Suppliers sales invoices are required to support the claim for refund.

Account Management Fuel Unit

3. No refund may be authorized unless a sworn or affirmed application is filed with the department

P.O. Box 6480

no later than the last day of the month following the quarter for which the refund is claimed.

Tallahassee, FL 32314-6480

4. Permits are not transferable, except to the executor or administrator of a deceased permit holder.

5. The Florida Department of Revenue will require a corporate surety bond of $1,000 with an

(800) 352-3671

Application For Refund Permit for any person who violates an applicable provision of Section

206.41, F.S., or is convicted of bribery, theft, or false swearing within the preceding five years, or if

NO FEE REQUIRED

the department has evidence of the applicant’s financial irresponsibility.

WITH THIS APPLICATION

For Official Use Only

Permit Number

Date Approved

Effective Date

Year End

Exam Initials

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs

obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as

public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at and select

“Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized

exceptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1