Form Bt-101 Instructions And Sample - Wisconsin Fermented Malt Beverage Tax Multiple Schedule

ADVERTISEMENT

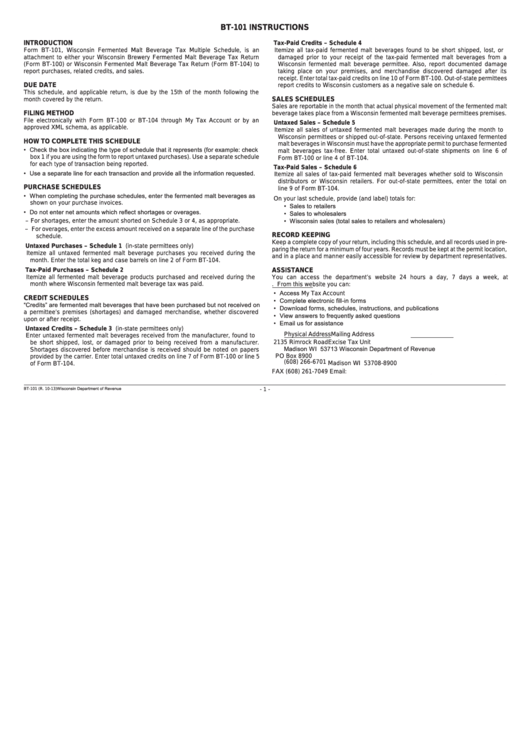

BT-101 INSTRUCTIONS

INTRODUCTION

Tax-Paid Credits – Schedule 4

Form BT-101, Wisconsin Fermented Malt Beverage Tax Multiple Schedule, is an

Itemize all tax-paid fermented malt beverages found to be short shipped, lost, or

attachment to either your Wisconsin Brewery Fermented Malt Beverage Tax Return

damaged prior to your receipt of the tax-paid fermented malt beverages from a

(Form BT-100) or Wisconsin Fermented Malt Beverage Tax Return (Form BT-104) to

Wisconsin fermented malt beverage permittee. Also, report documented damage

report purchases, related credits, and sales.

taking place on your premises, and merchandise discovered damaged after its

receipt. Enter total tax-paid credits on line 10 of Form BT-100. Out-of-state permittees

DUE DATE

report credits to Wisconsin customers as a negative sale on schedule 6.

This schedule, and applicable return, is due by the 15th of the month following the

SALES SCHEDULES

month covered by the return.

Sales are reportable in the month that actual physical movement of the fermented malt

FILING METHOD

beverage takes place from a Wisconsin fermented malt beverage permittees premises.

File electronically with Form BT-100 or BT-104 through My Tax Account or by an

Untaxed Sales – Schedule 5

approved XML schema, as applicable.

Itemize all sales of untaxed fermented malt beverages made during the month to

Wisconsin permittees or shipped out-of-state. Persons receiving untaxed fermented

HOW TO COMPLETE THIS SCHEDULE

malt beverages in Wisconsin must have the appropriate permit to purchase fermented

• Check the box indicating the type of schedule that it represents (for example: check

malt beverages tax-free. Enter total untaxed out-of-state shipments on line 6 of

box 1 if you are using the form to report untaxed purchases). Use a separate schedule

Form BT-100 or line 4 of BT-104.

for each type of transaction being reported.

Tax-Paid Sales – Schedule 6

• Use a separate line for each transaction and provide all the information requested.

Itemize all sales of tax-paid fermented malt beverages whether sold to Wisconsin

distributors or Wisconsin retailers. For out-of-state permittees, enter the total on

PURCHASE SCHEDULES

line 9 of Form BT-104.

• When completing the purchase schedules, enter the fermented malt beverages as

On your last schedule, provide (and label) totals for:

shown on your purchase invoices.

• Sales to retailers

• Do not enter net amounts which reflect shortages or overages.

• Sales to wholesalers

• Wisconsin sales (total sales to retailers and wholesalers)

– For shortages, enter the amount shorted on Schedule 3 or 4, as appropriate.

– For overages, enter the excess amount received on a separate line of the purchase

RECORD KEEPING

schedule.

Keep a complete copy of your return, including this schedule, and all records used in pre-

Untaxed Purchases – Schedule 1 (in-state permittees only)

paring the return for a minimum of four years. Records must be kept at the permit location,

Itemize all untaxed fermented malt beverage purchases you received during the

and in a place and manner easily accessible for review by department representatives.

month. Enter the total keg and case barrels on line 2 of Form BT-104.

Tax-Paid Purchases – Schedule 2

ASSISTANCE

Itemize all fermented malt beverage products purchased and received during the

You can access the department’s website 24 hours a day, 7 days a week, at

month where Wisconsin fermented malt beverage tax was paid.

revenue.wi.gov. From this website you can:

• Access My Tax Account

CREDIT SCHEDULES

• Complete electronic fill-in forms

“Credits” are fermented malt beverages that have been purchased but not received on

• Download forms, schedules, instructions, and publications

a permittee’s premises (shortages) and damaged merchandise, whether discovered

• View answers to frequently asked questions

upon or after receipt.

• Email us for assistance

Untaxed Credits – Schedule 3 (in-state permittees only)

Physical Address

Mailing Address

Enter untaxed fermented malt beverages received from the manufacturer, found to

be short shipped, lost, or damaged prior to being received from a manufacturer.

2135 Rimrock Road

Excise Tax Unit

Madison WI 53713

Wisconsin Department of Revenue

Shortages discovered before merchandise is received should be noted on papers

PO Box 8900

provided by the carrier. Enter total untaxed credits on line 7 of Form BT-100 or line 5

(608) 266-6701

Madison WI 53708-8900

of Form BT-104.

FAX (608) 261-7049

Email: excise@revenue.wi.gov

Wisconsin Department of Revenue

BT-101 (R. 10-13)

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2