Instructions For Rct-112

ADVERTISEMENT

Instructions for RCT-112

RCT-112-I (11-11)

Imposition, Base and Rate

Gross receipts tax is imposed on electric light companies, water power companies and hydro-electric companies – including electric distribution

companies and electric generation suppliers – that do business in Pennsylvania establishing or maintaining a market for the sale of electric energy.

The tax applies to retail sales of electric generation, transmission and distribution; supply of electric energy; dispatching and customer services;

competitive transition charges, intangible transition charges; universal service and energy conservation charges; and any other receipts considered

sales of electric energy.

Retail sales of electric generation occur at the retail customers’ meters.

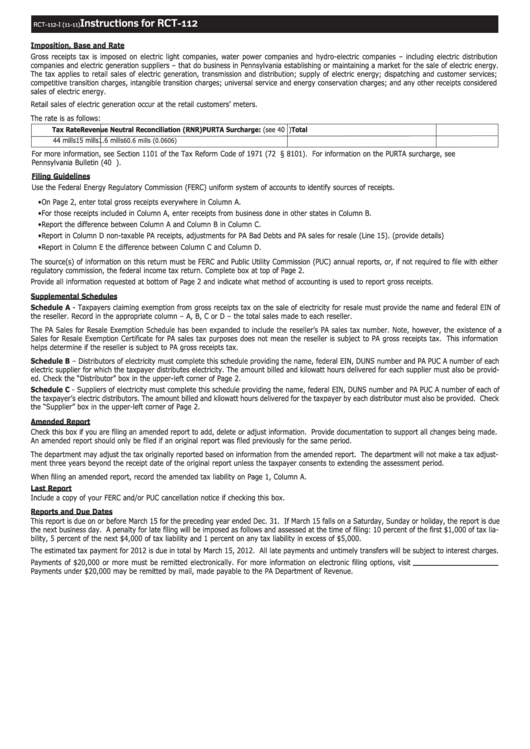

The rate is as follows:

Tax Rate

Revenue Neutral Reconciliation (RNR)

PURTA Surcharge: (see 40 Pa.B. 7304)

Total

44 mills

15 mills

1.6 mills

60.6 mills (0.0606)

For more information, see Section 1101 of the Tax Reform Code of 1971 (72 P.S. § 8101). For information on the PURTA surcharge, see

Pennsylvania Bulletin (40 Pa.B. 7304).

Filing Guidelines

Use the Federal Energy Regulatory Commission (FERC) uniform system of accounts to identify sources of receipts.

• On Page 2, enter total gross receipts everywhere in Column A.

• For those receipts included in Column A, enter receipts from business done in other states in Column B.

• Report the difference between Column A and Column B in Column C.

• Report in Column D non-taxable PA receipts, adjustments for PA Bad Debts and PA sales for resale (Line 15). (provide details)

• Report in Column E the difference between Column C and Column D.

The source(s) of information on this return must be FERC and Public Utility Commission (PUC) annual reports, or, if not required to file with either

regulatory commission, the federal income tax return. Complete box at top of Page 2.

Provide all information requested at bottom of Page 2 and indicate what method of accounting is used to report gross receipts.

Supplemental Schedules

Schedule A - Taxpayers claiming exemption from gross receipts tax on the sale of electricity for resale must provide the name and federal EIN of

the reseller. Record in the appropriate column – A, B, C or D – the total sales made to each reseller.

The PA Sales for Resale Exemption Schedule has been expanded to include the reseller’s PA sales tax number. Note, however, the existence of a

Sales for Resale Exemption Certificate for PA sales tax purposes does not mean the reseller is subject to PA gross receipts tax. This information

helps determine if the reseller is subject to PA gross receipts tax.

Schedule B – Distributors of electricity must complete this schedule providing the name, federal EIN, DUNS number and PA PUC A number of each

electric supplier for which the taxpayer distributes electricity. The amount billed and kilowatt hours delivered for each supplier must also be provid-

ed. Check the “Distributor” box in the upper-left corner of Page 2.

Schedule C - Suppliers of electricity must complete this schedule providing the name, federal EIN, DUNS number and PA PUC A number of each of

the taxpayer’s electric distributors. The amount billed and kilowatt hours delivered for the taxpayer by each distributor must also be provided. Check

the “Supplier” box in the upper-left corner of Page 2.

Amended Report

Check this box if you are filing an amended report to add, delete or adjust information. Provide documentation to support all changes being made.

An amended report should only be filed if an original report was filed previously for the same period.

The department may adjust the tax originally reported based on information from the amended report. The department will not make a tax adjust-

ment three years beyond the receipt date of the original report unless the taxpayer consents to extending the assessment period.

When filing an amended report, record the amended tax liability on Page 1, Column A.

Last Report

Include a copy of your FERC and/or PUC cancellation notice if checking this box.

Reports and Due Dates

This report is due on or before March 15 for the preceding year ended Dec. 31. If March 15 falls on a Saturday, Sunday or holiday, the report is due

the next business day. A penalty for late filing will be imposed as follows and assessed at the time of filing: 10 percent of the first $1,000 of tax lia-

bility, 5 percent of the next $4,000 of tax liability and 1 percent on any tax liability in excess of $5,000.

The estimated tax payment for 2012 is due in total by March 15, 2012. All late payments and untimely transfers will be subject to interest charges.

Payments of $20,000 or more must be remitted electronically. For more information on electronic filing options, visit

Payments under $20,000 may be remitted by mail, made payable to the PA Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2