Worksheet For Determining Estate Filing Requirement For Deaths Occurring In 2014

ADVERTISEMENT

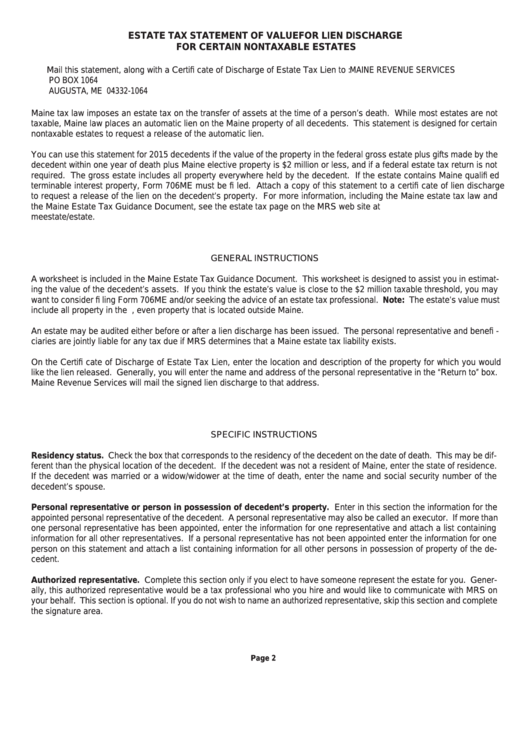

ESTATE TAX STATEMENT OF VALUE FOR LIEN DISCHARGE

FOR CERTAIN NONTAXABLE ESTATES

Mail this statement, along with a Certifi cate of Discharge of Estate Tax Lien to : MAINE REVENUE SERVICES

PO BOX 1064

AUGUSTA, ME 04332-1064

Maine tax law imposes an estate tax on the transfer of assets at the time of a person’s death. While most estates are not

taxable, Maine law places an automatic lien on the Maine property of all decedents. This statement is designed for certain

nontaxable estates to request a release of the automatic lien.

You can use this statement for 2015 decedents if the value of the property in the federal gross estate plus gifts made by the

decedent within one year of death plus Maine elective property is $2 million or less, and if a federal estate tax return is not

required. The gross estate includes all property everywhere held by the decedent. If the estate contains Maine qualifi ed

terminable interest property, Form 706ME must be fi led. Attach a copy of this statement to a certifi cate of lien discharge

to request a release of the lien on the decedent’s property. For more information, including the Maine estate tax law and

the Maine Estate Tax Guidance Document, see the estate tax page on the MRS web site at

meestate/estate.

GENERAL INSTRUCTIONS

A worksheet is included in the Maine Estate Tax Guidance Document. This worksheet is designed to assist you in estimat-

ing the value of the decedent’s assets. If you think the estate’s value is close to the $2 million taxable threshold, you may

want to consider fi ling Form 706ME and/or seeking the advice of an estate tax professional. Note: The estate’s value must

include all property in the U.S., even property that is located outside Maine.

An estate may be audited either before or after a lien discharge has been issued. The personal representative and benefi -

ciaries are jointly liable for any tax due if MRS determines that a Maine estate tax liability exists.

On the Certifi cate of Discharge of Estate Tax Lien, enter the location and description of the property for which you would

like the lien released. Generally, you will enter the name and address of the personal representative in the “Return to” box.

Maine Revenue Services will mail the signed lien discharge to that address.

SPECIFIC INSTRUCTIONS

Residency status. Check the box that corresponds to the residency of the decedent on the date of death. This may be dif-

ferent than the physical location of the decedent. If the decedent was not a resident of Maine, enter the state of residence.

If the decedent was married or a widow/widower at the time of death, enter the name and social security number of the

decedent’s spouse.

Personal representative or person in possession of decedent’s property. Enter in this section the information for the

appointed personal representative of the decedent. A personal representative may also be called an executor. If more than

one personal representative has been appointed, enter the information for one representative and attach a list containing

information for all other representatives. If a personal representative has not been appointed enter the information for one

person on this statement and attach a list containing information for all other persons in possession of property of the de-

cedent.

Authorized representative. Complete this section only if you elect to have someone represent the estate for you. Gener-

ally, this authorized representative would be a tax professional who you hire and would like to communicate with MRS on

your behalf. This section is optional. If you do not wish to name an authorized representative, skip this section and complete

the signature area.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2