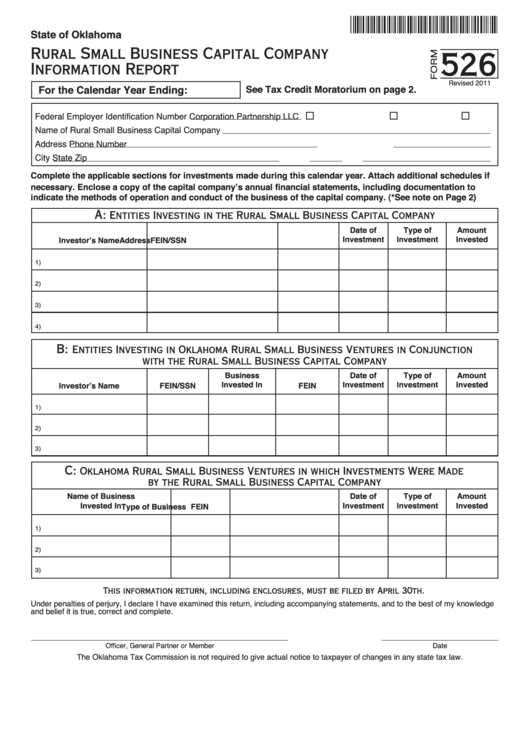

State of Oklahoma

Rural Small Business Capital Company

526

Information Report

Revised 2011

For the Calendar Year Ending:

See Tax Credit Moratorium on page 2.

Federal Employer Identification Number

Corporation

Partnership

LLC

Name of Rural Small Business Capital Company

Address

Phone Number

City

State

Zip

Complete the applicable sections for investments made during this calendar year. Attach additional schedules if

necessary. Enclose a copy of the capital company’s annual financial statements, including documentation to

indicate the methods of operation and conduct of the business of the capital company. (*See note on Page 2)

A:

Entities Investing in the Rural Small Business Capital Company

Date of

Type of

Amount

Investment

Investment

Invested

Investor’s Name

Address

FEIN/SSN

1)

2)

3)

4)

B:

Entities Investing in Oklahoma Rural Small Business Ventures in Conjunction

with the Rural Small Business Capital Company

Business

Date of

Type of

Amount

Invested In

Investment

Investment

Invested

Investor’s Name

FEIN/SSN

FEIN

1)

2)

3)

C:

Oklahoma Rural Small Business Ventures in which Investments Were Made

by the Rural Small Business Capital Company

Name of Business

Date of

Type of

Amount

Invested In

Investment

Investment

Invested

FEIN

Type of Business

1)

2)

3)

This information return, including enclosures, must be filed by April 30th.

Under penalties of perjury, I declare I have examined this return, including accompanying statements, and to the best of my knowledge

and belief it is true, correct and complete.

Officer, General Partner or Member

Date

The Oklahoma Tax Commission is not required to give actual notice to taxpayer of changes in any state tax law.

1

1 2

2 3

3