Form St-2-Ts Instructions - Expanded Temporary Storage Multiple Site Form

ADVERTISEMENT

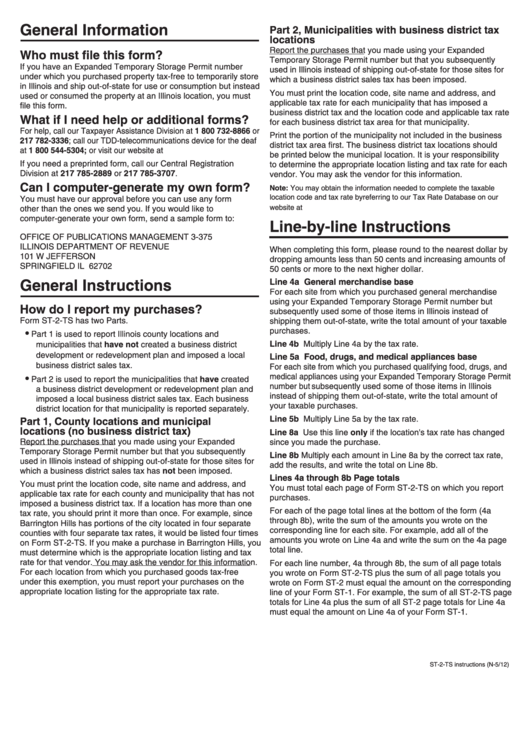

General Information

Part 2, Municipalities with business district tax

locations

Report the purchases that you made using your Expanded

Who must file this form?

Temporary Storage Permit number but that you subsequently

If you have an Expanded Temporary Storage Permit number

used in Illinois instead of shipping out-of-state for those sites for

under which you purchased property tax-free to temporarily store

which a business district sales tax has been imposed.

in Illinois and ship out-of-state for use or consumption but instead

You must print the location code, site name and address, and

used or consumed the property at an Illinois location, you must

applicable tax rate for each municipality that has imposed a

file this form.

business district tax and the location code and applicable tax rate

What if I need help or additional forms?

for each business district tax area for that municipality.

For help, call our Taxpayer Assistance Division at 1 800 732-8866 or

Print the portion of the municipality not included in the business

217 782-3336; call our TDD-telecommunications device for the deaf

district tax area first. The business district tax locations should

at 1 800 544-5304; or visit our website at tax.illinois.gov

be printed below the municipal location. It is your responsibility

If you need a preprinted form, call our Central Registration

to determine the appropriate location listing and tax rate for each

Division at 217 785-2889 or 217 785-3707.

vendor. You may ask the vendor for this information.

Can I computer-generate my own form?

Note: You may obtain the information needed to complete the taxable

location code and tax rate by referring to our Tax Rate Database on our

You must have our approval before you can use any form

website at tax.illinois.gov.

other than the ones we send you. If you would like to

computer-generate your own form, send a sample form to:

Line-by-line Instructions

OFFICE OF PUBLICATIONS MANAGEMENT 3-375

ILLINOIS DEPARTMENT OF REVENUE

When completing this form, please round to the nearest dollar by

101 W JEFFERSON

dropping amounts less than 50 cents and increasing amounts of

SPRINGFIELD IL 62702

50 cents or more to the next higher dollar.

General Instructions

Line 4a General merchandise base

For each site from which you purchased general merchandise

using your Expanded Temporary Storage Permit number but

How do I report my purchases?

subsequently used some of those items in Illinois instead of

Form ST-2-TS has two Parts.

shipping them out-of-state, write the total amount of your taxable

purchases.

•

Part 1 is used to report Illinois county locations and

Line 4b Multiply Line 4a by the tax rate.

municipalities that have not created a business district

development or redevelopment plan and imposed a local

Line 5a Food, drugs, and medical appliances base

business district sales tax.

For each site from which you purchased qualifying food, drugs, and

medical appliances using your Expanded Temporary Storage Permit

•

Part 2 is used to report the municipalities that have created

number but subsequently used some of those items in Illinois

a business district development or redevelopment plan and

instead of shipping them out-of-state, write the total amount of

imposed a local business district sales tax. Each business

your taxable purchases.

district location for that municipality is reported separately.

Line 5b Multiply Line 5a by the tax rate.

Part 1, County locations and municipal

locations (no business district tax)

Line 8a Use this line only if the location's tax rate has changed

Report the purchases that you made using your Expanded

since you made the purchase.

Temporary Storage Permit number but that you subsequently

Line 8b Multiply each amount in Line 8a by the correct tax rate,

used in Illinois instead of shipping out-of-state for those sites for

add the results, and write the total on Line 8b.

which a business district sales tax has not been imposed.

Lines 4a through 8b Page totals

You must print the location code, site name and address, and

You must total each page of Form ST-2-TS on which you report

applicable tax rate for each county and municipality that has not

purchases.

imposed a business district tax. If a location has more than one

For each of the page total lines at the bottom of the form (4a

tax rate, you should print it more than once. For example, since

through 8b), write the sum of the amounts you wrote on the

Barrington Hills has portions of the city located in four separate

corresponding line for each site. For example, add all of the

counties with four separate tax rates, it would be listed four times

amounts you wrote on Line 4a and write the sum on the 4a page

on Form ST-2-TS. If you make a purchase in Barrington Hills, you

total line.

must determine which is the appropriate location listing and tax

rate for that vendor. You may ask the vendor for this information.

For each line number, 4a through 8b, the sum of all page totals

For each location from which you purchased goods tax-free

you wrote on Form ST-2-TS plus the sum of all page totals you

under this exemption, you must report your purchases on the

wrote on Form ST-2 must equal the amount on the corresponding

appropriate location listing for the appropriate tax rate.

line of your Form ST-1. For example, the sum of all ST-2-TS page

totals for Line 4a plus the sum of all ST-2 page totals for Line 4a

must equal the amount on Line 4a of your Form ST-1.

ST-2-TS instructions (N-5/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1