Form Wv/bcs - Notice To Tax Commissioner Of Claim For West Virginia Business Investment And Jobs Expansion Credit

ADVERTISEMENT

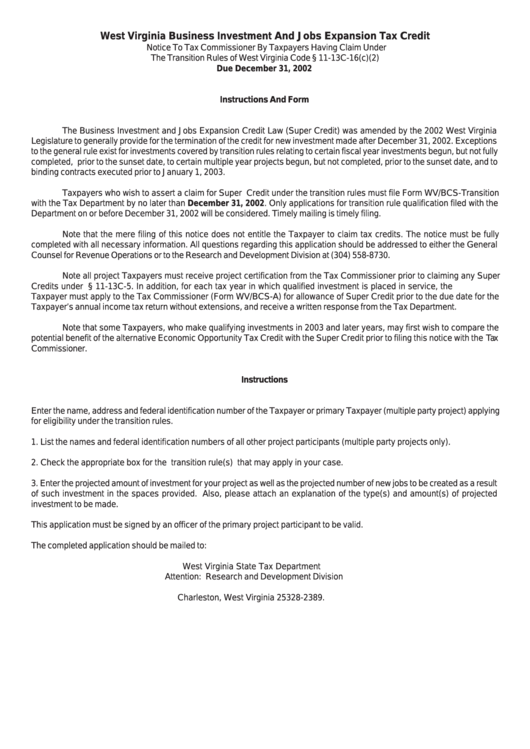

West Virginia Business Investment And Jobs Expansion Tax Credit

Notice To Tax Commissioner By Taxpayers Having Claim Under

The Transition Rules of West Virginia Code § 11-13C-16(c)(2)

Due December 31, 2002

Instructions And Form

The Business Investment and Jobs Expansion Credit Law (Super Credit) was amended by the 2002 West Virginia

Legislature to generally provide for the termination of the credit for new investment made after December 31, 2002. Exceptions

to the general rule exist for investments covered by transition rules relating to certain fiscal year investments begun, but not fully

completed, prior to the sunset date, to certain multiple year projects begun, but not completed, prior to the sunset date, and to

binding contracts executed prior to January 1, 2003.

Taxpayers who wish to assert a claim for Super Credit under the transition rules must file Form WV/BCS-Transition

with the Tax Department by no later than December 31, 2002. Only applications for transition rule qualification filed with the

Department on or before December 31, 2002 will be considered. Timely mailing is timely filing.

Note that the mere filing of this notice does not entitle the Taxpayer to claim tax credits. The notice must be fully

completed with all necessary information. All questions regarding this application should be addressed to either the General

Counsel for Revenue Operations or to the Research and Development Division at (304) 558-8730.

Note all project Taxpayers must receive project certification from the Tax Commissioner prior to claiming any Super

Credits under W.Va. Code § 11-13C-5. In addition, for each tax year in which qualified investment is placed in service, the

Taxpayer must apply to the Tax Commissioner (Form WV/BCS-A) for allowance of Super Credit prior to the due date for the

Taxpayer’s annual income tax return without extensions, and receive a written response from the Tax Department.

Note that some Taxpayers, who make qualifying investments in 2003 and later years, may first wish to compare the

potential benefit of the alternative Economic Opportunity Tax Credit with the Super Credit prior to filing this notice with the Tax

Commissioner.

Instructions

Enter the name, address and federal identification number of the Taxpayer or primary Taxpayer (multiple party project) applying

for eligibility under the transition rules.

1. List the names and federal identification numbers of all other project participants (multiple party projects only).

2. Check the appropriate box for the transition rule(s) that may apply in your case.

3. Enter the projected amount of investment for your project as well as the projected number of new jobs to be created as a result

of such investment in the spaces provided. Also, please attach an explanation of the type(s) and amount(s) of projected

investment to be made.

This application must be signed by an officer of the primary project participant to be valid.

The completed application should be mailed to:

West Virginia State Tax Department

Attention: Research and Development Division

P.O. Box 2389

Charleston, West Virginia 25328-2389.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2