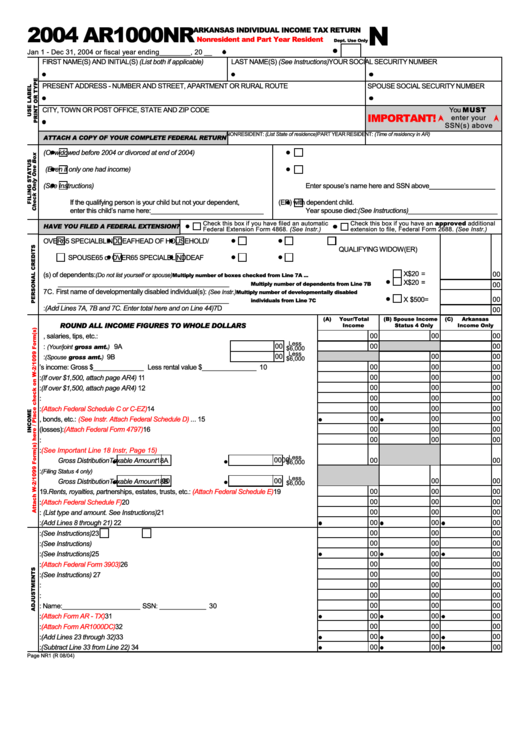

N

2004 AR1000NR

ARKANSAS INDIVIDUAL INCOME TAX RETURN

Nonresident and Part Year Resident

Dept. Use Only

Jan 1 - Dec 31, 2004 or fiscal year ending ________ , 20 __

FIRST NAME(S) AND INITIAL(S) (List both if applicable)

LAST NAME(S) (See Instructions)

YOUR SOCIAL SECURITY NUMBER

PRESENT ADDRESS - NUMBER AND STREET, APARTMENT OR RURAL ROUTE

SPOUSE SOCIAL SECURITY NUMBER

You MUST

CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

IMPORTANT!

enter your

SSN(s) above

NONRESIDENT: (List State of residence)

PART YEAR RESIDENT: (Time of residency in AR)

ATTACH A COPY OF YOUR COMPLETE FEDERAL RETURN

1.

SINGLE (Or widowed before 2004 or divorced at end of 2004)

4.

MARRIED FILING SEPARATELY ON THE SAME RETURN

2.

MARRIED FILING JOINT (Even if only one had income)

5.

MARRIED FILING SEPARATELY ON DIFFERENT RETURNS

3.

HEAD OF HOUSEHOLD (See Instructions)

Enter spouse’s name here and SSN above _________________

If the qualifying person is your child but not your dependent,

6.

QUALIFYING WIDOW(ER) with dependent child.

enter this child’s name here: _____________________________

Year spouse died:(See Instructions) _______________________

Check this box if you have an approved additional

Check this box if you have filed an automatic

HAVE YOU FILED A FEDERAL EXTENSION?

Federal Extension Form 4868. (See Instr.)

extension to file, Federal Form 2688. (See Instr.)

7A.

YOURSELF

65 or OVER

65 SPECIAL

BLIND

DEAF

HEAD OF HOUSEHOLD/

QUALIFYING WIDOW(ER)

SPOUSE

65 or OVER

65 SPECIAL

BLIND

DEAF

X $20 =

00

7B. First name(s) of dependents:

(Do not list yourself or spouse)

Multiply number of boxes checked from Line 7A ...

X $20 =

____________________________________________

Multiply number of dependents from Line 7B ........

00

7C. First name of developmentally disabled individual(s):

Multiply number of developmentally disabled

(See Instr.)

00

____________________________________________

X $500=

individuals from Line 7C .......................................

7D.TOTAL PERSONAL CREDITS: (Add Lines 7A, 7B and 7C. Enter total here and on Line 44) ..................................................... 7D

00

(A)

Your/Total

(B) Spouse Income

(C)

Arkansas

ROUND ALL INCOME FIGURES TO WHOLE DOLLARS

Income

Status 4 Only

Income Only

8.

Wages, salaries, tips, etc.: ........................................................................................... 8

00

00

00

Less

9A. U. S. military compensation pay:

(Your/joint gross amt.) .......

00

9A

00

00

$6,000

Less

(Spouse gross amt.) ..........

00

00

00

9B. U. S. military compensation pay:

9B

$6,000

00

00

00

10.

Minister’s income: Gross $ _____________ Less rental value $ ______________ 10

11.

Interest income: (If over $1,500, attach page AR4) ...................................................... 11

00

00

00

12.

Dividend income: (If over $1,500, attach page AR4) .................................................... 12

00

00

00

00

00

00

13.

Alimony and separate maintenance received: ............................................................ 13

00

00

00

14.

Business or professional income:

(Attach Federal Schedule C or C-EZ)

....................... 14

15.

Capital gains/losses from stocks, bonds, etc.:

(See Instr. Attach Federal Schedule D)

... 15

00

00

00

16.

Other gains or (losses):

(Attach Federal Form 4797)

................................................... 16

00

00

00

00

00

00

17.

Non-Qualified IRA distributions and taxable annuities: ................................................. 17

18A. Your/Joint Employer pension plan/Qualified IRA:

(See Important Line 18 Instr, Page 15)

Less

00

00

Gross Distribution

Taxable Amount

18A

00

00

$6,000

18B. Spouse Employer pension plan/Qualified IRA:

(Filing Status 4 only)

Less

00

00

00

00

Gross Distribution

Taxable Amount

18B

$6,000

00

00

00

19.

Rents, royalties, partnerships, estates, trusts, etc.:

(Attach Federal Schedule E)

........... 19

20.

Farm Income:

(Attach Federal Schedule F)

................................................................ 20

00

00

00

21.

Other income: (List type and amount. See Instructions) ............................................... 21

00

00

00

00

00

00

22.

TOTAL INCOME: (Add Lines 8 through 21) ................................................................ 22

00

00

00

23.

Payments to

IRA and

MSA: (See Instructions) ........................................ 23

00

00

00

24.

Deduction for interest paid on student loans:(See Instructions) .................................... 24

25.

Contributions to Intergenerational Trust: (See Instructions) .......................................... 25

00

00

00

00

00

00

26.

Moving expenses:

(Attach Federal Form 3903)

.......................................................... 26

00

00

00

27.

Self-employed health insurance deduction: (See Instructions) ..................................... 27

00

00

00

28.

KEOGH and Self-employed SEP and Simple Plans: .................................................. 28

29.

Forfeited interest penalty for premature withdrawal: .................................................... 29

00

00

00

00

00

00

30.

Alimony/sep. maint. paid to: Name: ____________________ SSN: ____________ 30

00

00

00

31.

Border city exemption:

(Attach Form AR - TX)

............................................................ 31

00

00

00

32.

Support for permanently disabled individual:

(Attach Form AR1000DC)

....................... 32

33.

TOTAL ADJUSTMENTS: (Add Lines 23 through 32) .................................................. 33

00

00

00

00

00

00

34.

ADJUSTED GROSS INCOME: (Subtract Line 33 from Line 22) .................................. 34

Page NR1 (R 08/04)

1

1 2

2