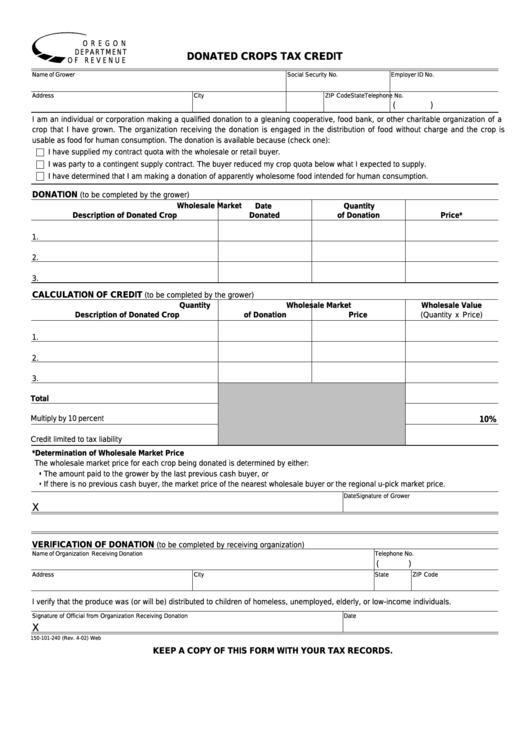

Donated Crops Tax Credit - Oregon Department Of Revenue

ADVERTISEMENT

O R E G O N

D E PA R T M E N T

DONATED CROPS TAX CREDIT

O F R E V E N U E

Name of Grower

Social Security No.

Employer ID No.

Address

City

State

ZIP Code

Telephone No.

(

)

I am an individual or corporation making a qualified donation to a gleaning cooperative, food bank, or other charitable organization of a

crop that I have grown. The organization receiving the donation is engaged in the distribution of food without charge and the crop is

usable as food for human consumption. The donation is available because (check one):

I have supplied my contract quota with the wholesale or retail buyer.

I was party to a contingent supply contract. The buyer reduced my crop quota below what I expected to supply.

I have determined that I am making a donation of apparently wholesome food intended for human consumption.

DONATION

(to be completed by the grower)

Date

Quantity

Wholesale Market

Description of Donated Crop

Donated

of Donation

Price*

1.

2.

3.

CALCULATION OF CREDIT

(to be completed by the grower)

Quantity

Wholesale Market

Wholesale Value

Description of Donated Crop

of Donation

Price

(Quantity x Price)

1.

2.

3.

Total

Multiply by 10 percent

10%

Credit limited to tax liability

*Determination of Wholesale Market Price

The wholesale market price for each crop being donated is determined by either:

• The amount paid to the grower by the last previous cash buyer, or

• If there is no previous cash buyer, the market price of the nearest wholesale buyer or the regional u-pick market price.

Signature of Grower

Date

X

VERIFICATION OF DONATION

(to be completed by receiving organization)

Name of Organization Receiving Donation

Telephone No.

(

)

Address

City

State

ZIP Code

I verify that the produce was (or will be) distributed to children of homeless, unemployed, elderly, or low-income individuals.

Signature of Official from Organization Receiving Donation

Date

X

150-101-240 (Rev. 4-02) Web

KEEP A COPY OF THIS FORM WITH YOUR TAX RECORDS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1