Form It-140v - Individual Income Tax Electronic Payment Voucher - 2011

ADVERTISEMENT

2011

IT-140V

West Virginia Individual Income Tax

Electronic Payment Voucher & Instructions

REV. 11-11

Do I need to use a payment voucher?

1. If you owe tax on your 2011 return, send the payment voucher to us with your payment. You must pay the

amount you owe by April 17, 2012, to avoid interest and penalties.

2. If your 2011 return shows a refund or no tax due, there is no need to use the payment voucher.

How do I prepare my payment?

1. Make your check or money order payable to the West Virginia State Tax Department. Do not send cash!

2. If your name and address are not printed on your check or money order, write them on it.

3. Write your Social Security Number (SSN), daytime phone number, and “2011 Form WV-140V” on your

payment.

How do I prepare the payment voucher?

1. Enter your SSN in the first block, top line, and the first four letters of your last name in the second block top

line.

2. If a joint return, enter your spouse’s SSN on the second line.

3. Enter the amount you are paying in the third block, top line.

4. Enter your name(s) and address on the last three lines.

How do I send my payment and the payment voucher

?

1. Detach the payment voucher at the perforation below.

2. DO NOT attach the payment voucher or your payment to your return or to each other. Instead, just put them

in your envelope that came with your tax package.

3. You must send your payment and payment voucher to an address different than that shown in your tax

package. Mail your payment and payment voucher to the following address:

West Virginia State Tax Department

Electronic Filing Office

P.O. Box 11385

Charleston, WV 25339-1385

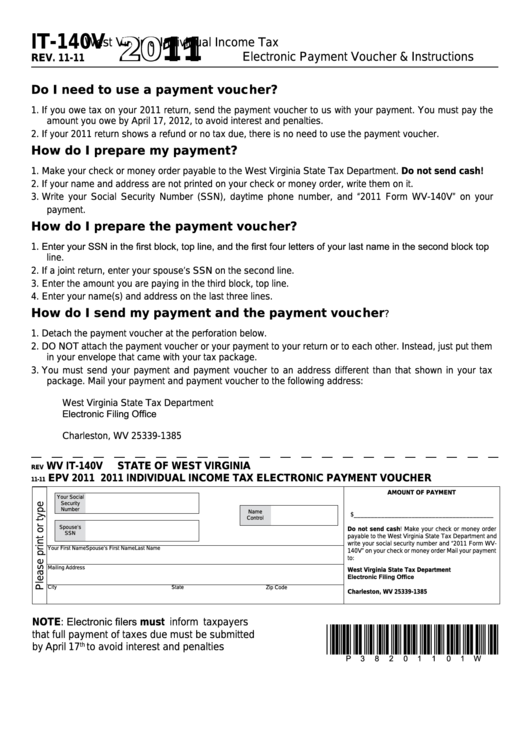

WV IT-140V

STATE OF WEST VIRGINIA

REV

EPV 2011

2011 INDIVIDUAL INCOME TAX ELECTRONIC PAYMENT VOUCHER

11-11

Amount of PAyment

Your Social

Security

Number

Name

$_________________________________________

Control

Spouse’s

Do not send cash! Make your check or money order

SSN

payable to the West Virginia State Tax Department and

write your social security number and “2011 Form WV-

Your First Name

Spouse’s First Name

Last Name

140V” on your check or money order Mail your payment

to:

Mailing Address

West Virginia State Tax Department

Electronic Filing Office

P.O. Box 11385

City

State

Zip Code

Charleston, WV 25339-1385

NOTE: Electronic filers must inform taxpayers

*p38201101W*

that full payment of taxes due must be submitted

by April 17

th

to avoid interest and penalties

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1