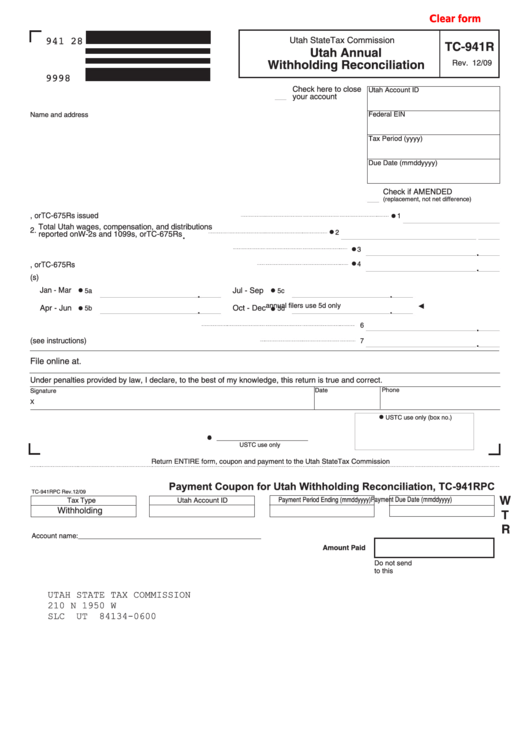

Clear form

941 2

8

Utah State Tax Commission

TC-941R

Utah Annual

Rev. 12/09

Withholding Reconciliation

9998

Check here to close

Utah Account ID

your account

Federal EIN

Name and address

Tax Period (yyyy)

Due Date (mmddyyyy)

Check if AMENDED

(replacement, not net difference)

1. Total number of Utah W-2s and 1099s, or TC-675Rs issued

1

Total Utah wages, compensation, and distributions

2.

2

.

reported on W-2s and 1099s, or TC-675Rs

3. Total federal income tax withheld on Utah W-2s and 1099s

3

.

4

4. Total Utah income tax withheld on W-2s and 1099s, or TC-675Rs

.

5. Utah tax withheld as reported on TC-941 return(s)

Jan - Mar

Jul - Sep

5a

5c

.

.

annual filers use 5d only

Apr - Jun

5b

.

Oct - Dec

.

5d

.

6

6. Add lines 5a through 5d and enter the total here

7. Subtract line 6 from line 4 and enter amount here (see instructions)

.

7

File online at

taxexpress.utah.gov

.

Under penalties provided by law, I declare, to the best of my knowledge, this return is true and correct.

Date

Phone

Signature

X

USTC use only (box no.)

_________________

USTC use only

Return ENTIRE form, coupon and payment to the Utah State Tax Commission

Payment Coupon for Utah Withholding Reconciliation, TC-941RPC

TC-941RPC Rev. 12/09

W

Payment Due Date (mmddyyyy)

Payment Period Ending (mmddyyyy)

Tax Type

Utah Account ID

Withholding

T

R

Account name: _______________________________________________

Amount Paid

Do not send cash. Do not staple check

to this coupon. Detach any check stub.

UTAH STATE TAX COMMISSION

210 N 1950 W

SLC

UT

84134-0600

1

1 2

2