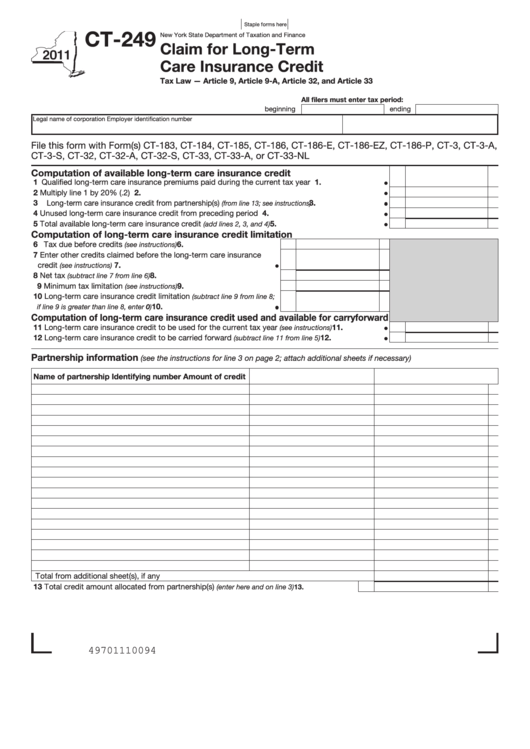

Staple forms here

CT-249

New York State Department of Taxation and Finance

Claim for Long-Term

Care Insurance Credit

Tax Law — Article 9, Article 9-A, Article 32, and Article 33

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form(s) CT-183, CT-184, CT-185, CT-186, CT-186-E, CT-186-EZ, CT-186-P, CT-3, CT-3-A,

CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-A, or CT-33-NL

Computation of available long-term care insurance credit

1 Qualified long-term care insurance premiums paid during the current tax year ...............................

1.

2 Multiply line 1 by 20% (.2) .................................................................................................................

2.

3 Long-term care insurance credit from partnership(s)

.................................

3.

(from line 13; see instructions)

4 Unused long-term care insurance credit from preceding period ......................................................

4.

5 Total available long-term care insurance credit

.................................................

5.

(add lines 2, 3, and 4)

Computation of long-term care insurance credit limitation

6 Tax due before credits

6.

............................................

(see instructions)

7 Enter other credits claimed before the long-term care insurance

credit

..................................................................

7.

(see instructions)

8 Net tax

.......................................................

8.

(subtract line 7 from line 6)

9 Minimum tax limitation

............................................

9.

(see instructions)

10 Long-term care insurance credit limitation

(subtract line 9 from line 8;

10.

................................................

if line 9 is greater than line 8, enter 0)

Computation of long-term care insurance credit used and available for carryforward

11 Long-term care insurance credit to be used for the current tax year

......................

11.

(see instructions)

12 Long-term care insurance credit to be carried forward

...........................

12.

(subtract line 11 from line 5)

Partnership information

(see the instructions for line 3 on page 2; attach additional sheets if necessary)

Name of partnership

Identifying number

Amount of credit

Total from additional sheet(s), if any

...............................................................................................................

13 Total credit amount allocated from partnership(s)

(enter here and on line 3) ............................... 13.

49701110094

1

1 2

2