Page 4

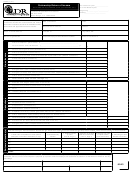

Schedule I — Balance sheets

Beginning of taxable year

End of taxable year

1

Cash

Notes and accounts receivable

2

(

) (

)

Less: Reserve for bad debts

Inventories:

3

(a) Other than last-in, first-out

(b) Last-in, first-out

4

Investments in Government obligations

Other current assets — including short-term

5

marketable investments (Attach schedule.)

6

Other investments (Attach schedule.)

Buildings and other fixed depreciable assets

7

(

) (

)

Less: Accumulated amortization and depreciation

Depletable assets

8

(

) (

)

Less: Accumulated depletion

9

Land (net of any amortization)

Intangible assets (amortizable only)

10

Less: Accumulated amortization

(

) (

)

11

Other assets (Attach schedule.)

$

$

12

Total assets

13

Accounts payable

Mortgages, notes, and loans payable (short term):

14

(a) Banks

(b) Others

15

Other current liabilities (Attach schedule.)

Mortgages, notes, and loans payable (long term):

16

(a) Banks

(b) Others

17

Other liabilities (Attach schedule.)

18

Partners’ capital accounts

19

Total liabilities and capital

$

$

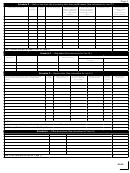

Schedule J — Reconciliation of partners’ capital accounts

1. Capital account at

2. Capital contributed

3. Income not

4. Ordinary income

5. Losses not

6. Withdrawals and

7. Capital account

beginning of year

during year

included

(or loss) from Line 28,

included

distributions

at end of year

in Column 4, plus

Page 1

in Column 4, plus un-

nontaxable income

allowable deductions

(a)

(b)

(c)

(d)

(e)

Totals

$

$

$

$

$

$

$

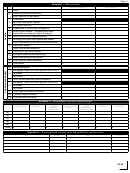

Schedule K — Income reported in federal return and omitted from Louisiana return

Item

Amount

Item

Amount

6046

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12